Get Vt Form 831

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vt Form 831 online

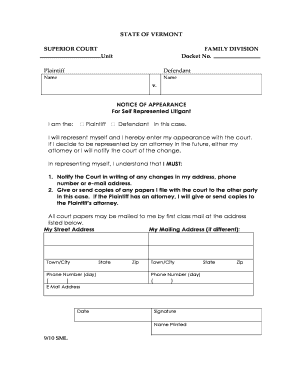

Navigating the process of filling out the Vt Form 831 can seem daunting, but with clear instructions and guidance, you can complete it with ease. This guide will walk you through each section of the form, ensuring you understand the requirements and can submit your information confidently.

Follow the steps to complete the Vt Form 831 online successfully.

- Press the ‘Get Form’ button to access the Vt Form 831 and open it in your preferred online editor.

- Identify your role in the case by selecting either 'Plaintiff' or 'Defendant' in the designated checkbox.

- Indicate that you will represent yourself by acknowledging your status as a self-represented litigant. This is typically in a statement provided in the form.

- Provide written notice to the court regarding any future representation changes. Be sure to include a statement indicating you will notify the court if you choose to hire an attorney.

- Fill in your contact information, including your street address and, if applicable, your mailing address. Ensure these are accurate to facilitate correct communication.

- Include your day phone number, ensuring it is reachable during business hours.

- Enter your email address accurately to receive notifications from the court.

- Sign and date the form, ensuring you print your name clearly for verification.

- After completing the form, you can save your changes, download the completed form, print it for your records, or share it as needed.

Start filling out your documents online today to ensure a smooth and efficient process!

The VT Form 113 is a tax schedule that accompanies the Vermont tax return, allowing taxpayers to calculate specific deductions or credits. It is particularly designed for certain income types or projects that qualify for special tax treatment. Filing the VT Form 113 is crucial for taxpayers to accurately reflect all relevant tax deductions. To ensure you fill out both the VT Form 113 and the VT Form 831 correctly, consider the assistance offered by the resources available on US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.