Get Ftb 3701

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3701 online

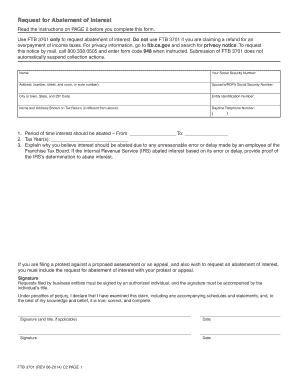

The Ftb 3701 form is used to request an abatement of interest charged by the Franchise Tax Board. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete your Ftb 3701 online.

- Click ‘Get Form’ button to access the Ftb 3701 and open it in your online editor.

- Enter your name and Social Security number in the designated fields to identify yourself as the requester.

- Provide your address, including the city, state, and ZIP code, ensuring all details are accurate.

- If applicable, include your spouse’s or registered domestic partner’s Social Security number.

- If you are submitting this request on behalf of a business entity, enter the Entity Identification Number as required.

- Complete the section that asks for the name and address shown on your tax return, if this differs from the information already provided.

- Fill in your daytime telephone number for contact purposes.

- Specify the period of time for which you are requesting the abatement of interest, providing both start and end dates.

- List the tax years related to your request for interest abatement.

- Clearly explain the reasons for your request. Detail any unreasonable errors or delays made by the Franchise Tax Board or provide proof if the IRS abated interest.

- Sign the form. If you are representing a business, ensure an authorized individual signs and includes their title.

- Finally, save your changes and download the completed form. You may print it for mailing, or share it as necessary.

Complete your Ftb 3701 form online today for an efficient request process.

To request an abatement of interest in California, you must submit a formal request to the California Franchise Tax Board, explaining the reasons for your request and providing supporting documentation. Common grounds for abatement may include delays caused by the FTB or situations qualifying as reasonable cause. Effective preparation can streamline your request, and uslegalforms offers templates and guidance that can help you craft a compelling appeal related to FTB 3701.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.