Loading

Get Ms 83 180

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ms 83 180 online

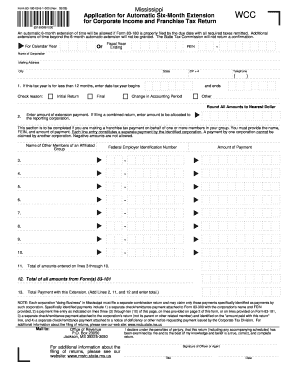

The Ms 83 180 form is an application for an automatic six-month extension for corporate income and franchise tax returns in Mississippi. This guide provides step-by-step instructions to help users accurately complete the form online.

Follow the steps to successfully complete the Ms 83 180 online.

- Click the ‘Get Form’ button to obtain the Ms 83 180 form and open it in your preferred online editor.

- Begin by entering the tax year for which you are applying for an extension. If the tax year lasts less than twelve months, provide the start date of the tax year.

- Fill in the corporation's name, mailing address, city, state, and ZIP code. Include the Federal Employer Identification Number (FEIN).

- Clearly state the reason for the extension request by checking the appropriate box among the options provided.

- In the section designated for payment, round all amounts to the nearest dollar and enter the amount of extension payment you are submitting.

- If applicable, provide detailed information about any franchise tax payments being made on behalf of an affiliated group. This includes the names and FEINs of other members.

- After completing the form, review all entries for accuracy. You can then choose to save the changes, download the completed form, print it, or share it as necessary.

Complete your documents online efficiently today.

Yes, Mississippi has a state income tax form known as Form 80-105 for individuals. This form is essential for reporting personal income and determining the tax due. If you're looking for reliable support in filling out your tax forms and understanding state requirements, USLegalForms is an excellent resource for matters under Ms 83 180.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.