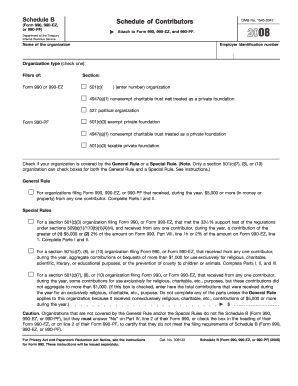

Get F990sb Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign F990sb Form online

How to fill out and sign F990sb Form online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Getting a legal specialist, creating a scheduled visit and going to the business office for a private meeting makes doing a F990sb Form from beginning to end stressful. US Legal Forms allows you to quickly produce legally valid documents based on pre-created web-based blanks.

Perform your docs within a few minutes using our easy step-by-step guideline:

- Get the F990sb Form you want.

- Open it with online editor and begin editing.

- Fill the empty fields; concerned parties names, addresses and numbers etc.

- Change the blanks with exclusive fillable fields.

- Add the day/time and place your e-signature.

- Simply click Done after double-examining everything.

- Save the ready-made record to your gadget or print it as a hard copy.

Rapidly produce a F990sb Form without needing to involve specialists. We already have more than 3 million customers making the most of our unique collection of legal forms. Join us right now and gain access to the #1 library of web samples. Try it yourself!

How to edit F990sb Form: customize forms online

Use our advanced editor to turn a simple online template into a completed document. Read on to learn how to edit F990sb Form online easily.

Once you discover a perfect F990sb Form, all you have to do is adjust the template to your preferences or legal requirements. Apart from completing the fillable form with accurate details, you may need to delete some provisions in the document that are irrelevant to your case. Alternatively, you might want to add some missing conditions in the original template. Our advanced document editing features are the best way to fix and adjust the form.

The editor allows you to modify the content of any form, even if the document is in PDF format. It is possible to add and remove text, insert fillable fields, and make additional changes while keeping the initial formatting of the document. You can also rearrange the structure of the form by changing page order.

You don’t have to print the F990sb Form to sign it. The editor comes along with electronic signature capabilities. Most of the forms already have signature fields. So, you simply need to add your signature and request one from the other signing party with a few clicks.

Follow this step-by-step guide to build your F990sb Form:

- Open the preferred template.

- Use the toolbar to adjust the form to your preferences.

- Fill out the form providing accurate details.

- Click on the signature field and add your electronic signature.

- Send the document for signature to other signers if necessary.

Once all parties sign the document, you will receive a signed copy which you can download, print, and share with others.

Our services enable you to save tons of your time and minimize the chance of an error in your documents. Improve your document workflows with effective editing tools and a powerful eSignature solution.

To fill an income declaration form, begin by gathering all relevant income-related documents. Carefully complete the F990sb Form, ensuring you input the correct figures. Review the form thoroughly to check for errors before submission, as accuracy is crucial.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.