Loading

Get Lsfcu

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lsfcu online

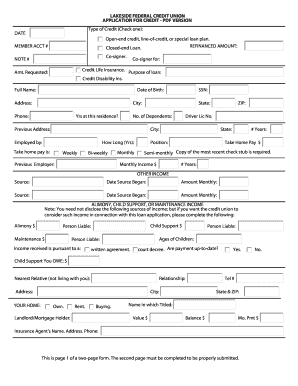

This guide offers a detailed approach to completing the Lsfcu application for credit online. It outlines each section of the form, ensuring users can fill it out accurately and efficiently.

Follow the steps to effectively complete your Lsfcu application.

- Press the ‘Get Form’ button to access the application form and open it in your preferred editor.

- Select the type of credit you are applying for by checking the appropriate box: open-end credit, line-of-credit, or closed-end loan. Indicate the refinanced amount if applicable.

- Provide your member account number, note number, and the amount requested for the loan, along with the purpose of the loan.

- Fill in your personal details, including full name, date of birth, address, social security number, and phone number. Ensure the information is accurate.

- Indicate how many years you have lived at your current residence and the number of dependents.

- If applicable, provide your previous address and additional information such as driver’s license number and employment details, including your employer and how long you have been employed.

- Detail your take-home pay, specifying the frequency (weekly, bi-weekly, or monthly). A copy of your recent pay stub is required.

- Provide information on any other income sources, including alimony or child support, and indicate if they are received under a written agreement or court decree.

- Fill out your housing situation, noting whether you own, rent, or are buying your home. Include details about your landlord or mortgage holder and the property value.

- On the second page, input your automobile information if applicable, detailing the make, year, and financial details pertaining to your vehicles.

- List any creditors and liabilities you have, including account numbers, amounts owed, and monthly payments.

- Indicate whether you have ever filed for bankruptcy and provide relevant details if applicable.

- Complete the signature section, affirming the accuracy of the provided information. If emailing, check the box for your electronic signature.

- Once completed, you can save your changes, print the form, or share it via email as instructed.

Complete your Lsfcu application online today for a streamlined credit experience.

While banking with a credit union like LSFcu has many benefits, some downsides exist. Credit unions may offer fewer branches or ATMs compared to larger banks, which can affect accessibility. Additionally, not all credit unions may have as comprehensive an array of services as larger banks. However, the personalized service and lower fees often outweigh these concerns for many members.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.