Get Commonwealth Of Virginia Department Of Taxation W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Commonwealth Of Virginia Department Of Taxation W 9 Form online

Filling out the Commonwealth Of Virginia Department Of Taxation W 9 Form online can seem daunting, but with clear guidance and structured steps, you can complete it efficiently. This guide aims to help you navigate the form's sections and fields with ease, ensuring you provide the necessary information accurately.

Follow the steps to fill out the form online:

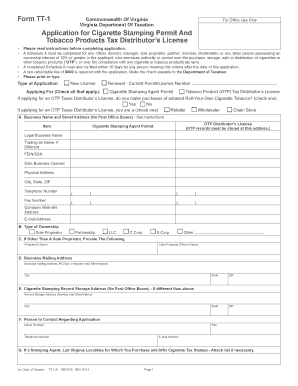

- Click ‘Get Form’ button to access the Commonwealth Of Virginia Department Of Taxation W 9 Form and open it in your digital workspace.

- Begin by entering your legal business name and the name under which you operate (If different) in the designated fields.

- Input your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) as applicable.

- Fill in the date your business was established.

- Provide your physical business address, city, state, and ZIP code.

- Enter your telephone and fax numbers, as well as your business website, if applicable.

- List your email address for official correspondence.

- Select the type of ownership for your business from the options provided: Sole Proprietor, Partnership, LLC, Corporation, or Other.

- If your business is not a sole proprietorship, provide the names of key officers such as the President and Chief Financial Officer.

- Indicate your business mailing address, ensuring to include a proper postal box if necessary.

- If applicable, provide a storage address for your Cigarette Stamping Records, clearly indicating if it differs from your physical address.

- Designate a contact person for inquiries regarding the application, including their name, title, telephone number, and email address.

- List Virginia localities where you plan to purchase and affix cigarette tax stamps, attaching additional documentation if necessary.

- Describe your primary business activity and check all relevant boxes related to your operations, including any online sales.

- Complete and attach the required Schedule A forms for any individuals meeting the 10% ownership criteria.

- Answer the questions regarding your tax compliance status and previous business operations outside Virginia.

- Provide your declaration and signature, ensuring that the individual signing is authorized as per the business type.

- Finally, review all entries for accuracy, save your changes, and download or print the completed form for submission.

Start completing your documents online today for a smoother application process.

Virginia tax forms are available on the Commonwealth of Virginia Department of Taxation's official website, where you can download and print the necessary documentation. In addition, local offices and public libraries often provide physical copies for your convenience. If you need specific forms like the Commonwealth of Virginia Department of Taxation W 9 Form, be sure to check online for the most current version. Remember, using the right forms is essential for accurate tax filing.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.