Get Arizona Joint Tax Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

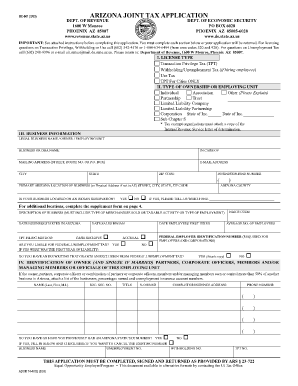

How to fill out the Arizona Joint Tax Application Form online

This guide provides clear instructions for completing the Arizona Joint Tax Application Form online. By following these steps, users can efficiently submit their application for various tax licenses in Arizona, ensuring compliance and facilitating smooth business operations.

Follow the steps to complete your application accurately.

- Click the ‘Get Form’ button to obtain the Arizona Joint Tax Application Form and open it in the document editor.

- Identify the license type that applies to your business. Options include Transaction Privilege Tax, Withholding/Unemployment Tax, Use Tax, or TPT for Cities only. Make the appropriate selection on the form.

- Indicate the type of ownership for your business by checking the relevant box. Choices include Individual, Association, Partnership, Corporation, and more. If necessary, provide additional explanation for your selection.

- Enter the required business information, including the legal business name, any 'doing business as' (DBA) name, mailing address, email, phone number, and the physical location of your business in Arizona.

- Provide details about your business activities, including the North American Industry Classification System (NAICS) code and a description of the type of merchandise sold or services offered.

- Fill out the section regarding employment information, including Federal Employer Identification Number, dates employees were first hired, and the average number of employees.

- Complete the identification section for owners, partners, and members of the business, including their names, titles, and social security numbers.

- Review the fees associated with the transaction privilege tax and calculate any applicable city fees based on the number of locations.

- Sign the application, certifying that all information provided is accurate. This must be done by an individual authorized to represent the business.

- Once all sections are completed, save your changes, download a copy of the form for your records, and print the application if needed. Submit the form as directed, along with any required attachments and payment.

Complete your Arizona Joint Tax Application Form online today and ensure your business is fully compliant.

Your Arizona tax withholding form should include your personal identification details, including your Social Security number and filing status. Be sure to accurately report any additional income or exemptions that may affect your withholding rate. Properly completing this form ensures that the right amount is withheld from your paycheck, aiding in effective tax planning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.