Loading

Get Form Pa 8453

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Pa 8453 online

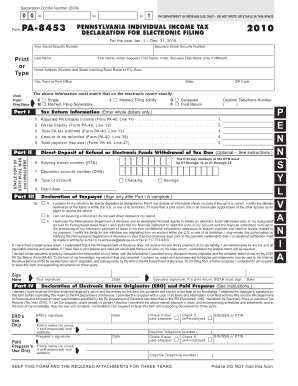

Filling out Form Pa 8453 is an essential step for Pennsylvania taxpayers who are filing their individual income tax returns electronically. This guide will provide you with detailed instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to successfully fill out Form Pa 8453 online.

- Press the ‘Get Form’ button to access the form, allowing you to start the online filling process.

- Begin with Part I by entering your name and social security number in the respective fields provided. Ensure the information matches your electronic tax return exactly.

- Complete your address information, including city, state, and ZIP code. Make sure that this matches the address on your electronically filed PA-40.

- Select your filing status by checking one of the options: 'Single', 'Married, Filing Separately', 'Married, Filing Jointly', 'Deceased', or 'Final Return'.

- Fill in your daytime telephone number to ensure easy communication if needed.

- In Part II, provide your Adjusted PA taxable income, PA tax liability, total PA tax withheld, amount to be refunded, and total payment due. Enter amounts in whole dollars only.

- If you would like to set up direct deposit for your refund or electronic withdrawal for tax owed, fill in the routing transit number and depositor account number. Select the type of account and enter the desired debit date.

- In Part III, declare your tax information by checking the appropriate box to consent to direct deposit, or indicate you are not receiving a refund.

- Have the designated taxpayer sign and date the form. If filing jointly, ensure the spouse also signs.

- In Part IV, the Electronic Return Originator (ERO) or paid preparer must complete their section, signing and providing their details. Remember to keep a copy of this form for your records.

- Upon final review, utilize the options provided to save your changes, download, print, or share your completed form.

Take the next step towards your Pennsylvania tax filing by completing Form Pa 8453 online today.

To obtain a Pennsylvania tax transcript, you can request it through the Pennsylvania Department of Revenue's online services. Alternatively, you can call their customer service for assistance or mail in a request form. Using the uslegalforms platform can simplify this process, providing you with the necessary forms and guidance to successfully get your tax transcript.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.