Get Ppt 4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ppt 4 Form online

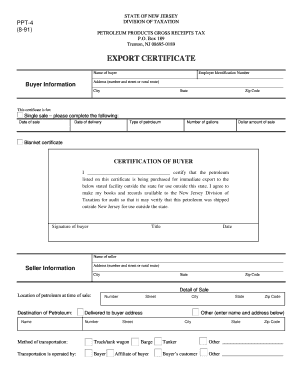

The Ppt 4 Form, also known as the Petroleum Products Gross Receipts Tax Export Certificate, is an essential document for buyers purchasing petroleum products for immediate export outside New Jersey. This guide provides step-by-step instructions to assist you in completing the form accurately online.

Follow the steps to fill out the Ppt 4 Form online.

- Click 'Get Form' button to obtain the form and open it in your chosen editing tool.

- Fill in the buyer information section by entering the name of the buyer and their employer identification number. Provide the address, including the number and street, city, state, and zip code.

- Indicate whether this certificate is for a single sale or a blanket certificate. If for a single sale, complete the additional details: date of sale, date of delivery, type of petroleum, number of gallons, and dollar amount of sale.

- In the certification of buyer section, write your full name to certify the statement regarding the purchase of petroleum for export. Include your title and the date of signing.

- Provide the seller information by entering the name, address, city, state, and zip code of the seller.

- Fill out the detail of sale section, specifying the location of the petroleum at the time of sale and the destination of the petroleum, including the name, number, street, city, and zip code.

- Indicate the method of transportation by checking the appropriate option and providing details such as whether the transportation is operated by the buyer, an affiliate, or another entity.

- Finally, review all entries for accuracy. Once you confirm that all sections are filled correctly, you can save your changes, download the form, print a copy, or share the completed form as needed.

Complete your Ppt 4 Form online today to ensure compliance with New Jersey tax regulations.

The NJ ST-4 form serves as a Sales Tax Exempt Certificate in New Jersey. It allows eligible purchasers to buy goods or services without paying sales tax. Typically, this form is used by tax-exempt organizations or government entities that qualify under state law. To streamline this process, you can easily access and utilize the Ppt 4 Form through the UsLegalForms platform, ensuring you meet all legal requirements efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.