Loading

Get Find Form Titled Tax Exempt Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Find Form Titled Tax Exempt Return online

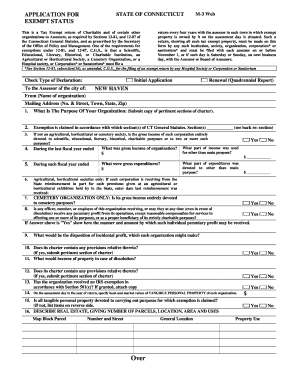

Filing the Find Form Titled Tax Exempt Return online is an essential step for organizations seeking to maintain their tax-exempt status. This guide provides clear and detailed instructions on how to accurately complete each section of the form to ensure compliance with Connecticut regulations.

Follow the steps to complete the Tax Exempt Return with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the type of declaration: either 'Initial Application' or 'Renewal (Quadrennial Report)'. Fill in the city name for the Assessor, in this case, 'NEW HAVEN'.

- Provide the name of the organization and its mailing address, including the number, street, town, state, and zip code.

- Explain the purpose of the organization by submitting a copy of the relevant sections of your charter.

- Indicate the section(s) of the Connecticut General Statutes under which the exemption is claimed.

- Answer whether the gross income of the organization is entirely devoted to the purposes outlined, and detail any income used for other purposes, including amounts and fiscal year end dates.

- If applicable, provide details specific to agricultural or horticultural societies, such as the date of the last state reimbursement received.

- For cemetery organizations, confirm if gross income is entirely devoted to cemetery purposes.

- Confirm if any individual associated with the organization could receive pecuniary profit from its operations and provide the manner and amount if applicable.

- Describe the organization’s policies regarding incidental profits and property disposition in case of dissolution. Submit relevant sections of the charter if necessary.

- Indicate if the organization has received IRS exemption under Section 501(c) and attach a copy of the determination letter.

- On the assessment day, specify the book and market values of all tangible personal property owned by the organization.

- Confirm that all tangible personal property is utilized for the exemption purposes claimed.

- Provide a description of the real estate owned by the organization, including parcel numbers, locations, areas, and uses.

- Confirm whether all real estate is used exclusively for the organization's purposes, and if not, describe other uses and the percentage of time used for those purposes.

- Indicate any real estate currently under construction.

- Report whether any portion of the real estate is rented and provide additional remarks as necessary.

- Finally, declare the truthfulness of the report by signing and dating it, and ensure it is subscribed and sworn to before an authorized individual.

- Once completed, save the changes, and choose to download, print, or share the form as needed.

Complete your Tax Exempt Return online today to ensure your organization's compliance and maintain your tax-exempt status.

Yes, tax-exempt certificates are public records. This means anyone can access them, allowing you to find information about tax-exempt organizations. If you wish to find Form Titled Tax Exempt Return, these records can provide clarity on an organization's tax status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.