Get Dtf 280

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DTF 280 online

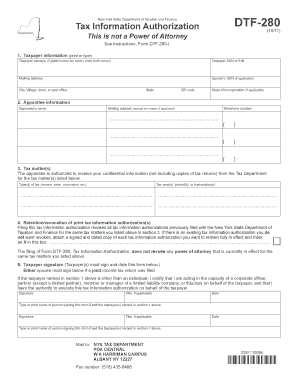

The DTF 280 form, also known as the Tax Information Authorization, is an essential document for individuals who wish to authorize someone to receive their confidential tax information from the New York State Department of Taxation and Finance. This guide provides a comprehensive, step-by-step approach to filling out the DTF 280 online, ensuring that users can submit this important form correctly and efficiently.

Follow the steps to complete the DTF 280 form online

- To begin, click the ‘Get Form’ button to access the DTF 280 form and open it in your preferred editor.

- In the first section, enter the taxpayer information. This includes the taxpayer name(s), taxpayer Social Security Number (SSN) or Employer Identification Number (EIN), and the mailing address. If applicable, include the spouse’s SSN and state of incorporation.

- Proceed to the appointee information section. Here, enter the appointee's name, mailing address (including firm name if relevant), and their telephone number.

- In the tax matters section, specify the type(s) of tax involved (such as income, sales, or corporation) and include the relevant tax year(s), period(s), or transaction(s). This allows the appointee to receive confidential details from the Tax Department.

- For retention or revocation of prior tax information authorizations, mark the box if you have previous authorizations you want to retain. Make sure to attach signed and dated copies of those authorizations.

- The final section requires the taxpayer(s) signature. If this is a joint return, either spouse may sign. If the signer is not the taxpayer, indicate their title and print or type their name.

- Once all fields are completed, review the form for accuracy. You may then save your changes, download the form as a file, print it for your records, or share it as needed.

Complete your DTF 280 form online today and ensure efficient management of your tax information!

To achieve brighter DTF prints, start by ensuring you are using high-quality inks specifically designed for DTF printing. Increasing the ink saturation in your printer settings can also make a difference. Lastly, employing the DTF 280 method will help deliver clearer and brighter prints, ensuring your designs look stunning.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.