Loading

Get 1997 Form 941 V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1997 Form 941 V online

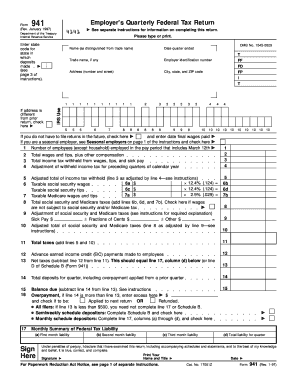

Filling out the 1997 Form 941 V online can streamline your reporting process for employer's quarterly federal tax returns. This guide will walk you through each section of the form, ensuring you complete it accurately and efficiently.

Follow the steps to accurately complete the 1997 Form 941 V.

- Click 'Get Form' button to download the 1997 Form 941 V and open it in your preferred editor.

- Begin by entering your employer identification number and the employer's name in the designated fields. Ensure that the name matches the legal name of the entity filing.

- Fill in the address, including the street number, city, state, and ZIP code. This information is important for accurate processing.

- Indicate the date the quarter ended. This helps the IRS determine the correct tax period for your submission.

- List the number of employees you employed during the pay period that includes March 12. This information is crucial for calculating liabilities.

- Proceed to calculate the taxable social security wages and tips using the provided formulas. Make sure to check the corresponding boxes as instructed.

- Adjust your total income tax withheld and incorporate any adjustments needed for the current quarter and preceding quarters.

- Calculate the total taxes by adding the relevant lines. Carefully review to ensure that your computations are accurate.

- If applicable, fill out the advance earned income credit payments made to employees and any overpayment information.

- Finalize your return by signing and dating the form. A complete signature ensures the validity of your submission.

- Save your changes, and when ready, download, print, or share your completed form with the appropriate parties.

Complete your documents online to ensure timely and accurate filing.

You should mail your Form 941 V to the address specified in the filing instructions based on your state. Double-check that you're sending it along with the 1997 Form 941 V to guarantee that your payments are processed correctly. Remember to keep a copy for your records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.