Loading

Get Form 3614

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3614 online

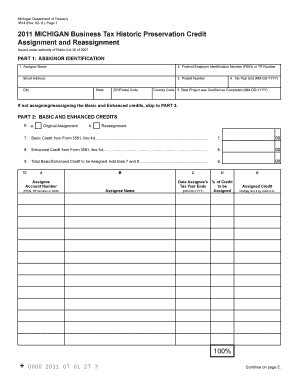

Form 3614 is used by Michigan Business Tax filers to assign or reassign the Historic Preservation Credit. This guide provides a clear and supportive step-by-step approach to help you complete the form accurately online.

Follow the steps to fill out the Form 3614 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part 1, fill in the assignor identification section: Enter the assignor name, Federal Employer Identification Number (FEIN) or TR Number, project number, address, city, state, ZIP/Postal code, tax year end, and the date the project was certified as completed.

- If not assigning or reassigning the Basic and Enhanced credits, proceed to Part 3. Otherwise, complete Part 2, where you will check whether it is an original assignment or a reassignment and enter the Basic and Enhanced Credit amounts from Form 3581.

- For each assignee in Part 2, provide their account number (FEIN, TR Number, or SSN), name, tax year end date, and the percentage of the credit assigned. Ensure the total percentage equals 100%.

- Complete Part 3 if you are assigning the Special Consideration Credit. Indicate whether this is an original assignment or reassignment, and fill in the necessary details, including maximum claimed amounts.

- In Part 4, certify the information by including the assignor's signature, printed name, and title. This step is essential for the form’s validity.

- Once all sections are complete, save changes, download, print, or share the completed form as necessary for your records.

Complete your Form 3614 online today to ensure your Historic Preservation Credit is properly assigned.

You can access form 1099A through the IRS website, which allows you to download and complete the form electronically. Tax assistance platforms like uslegalforms can also guide you through the entire process, providing templates and expert advice on how to fill it out properly. Staying informed will help you file accurately and on time.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.