Get Sc4868

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC4868 online

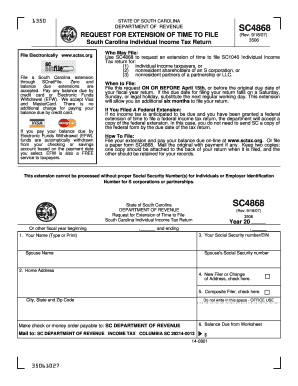

This guide provides clear and comprehensive instructions for filling out the SC4868 form, which allows for an extension of time to file your South Carolina individual income tax return. Whether you have prior experience or are new to tax filing, this step-by-step approach will assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete your SC4868 online.

- Press the ‘Get Form’ button to access the SC4868 form and open it in your preferred editing tool.

- Provide your name and, if applicable, your spouse's name in the designated fields. Ensure that all names are spelled correctly.

- Enter your home address, including city, state, and zip code. If you have moved since your last filing, check the box indicating a change of address.

- Input your Social Security number and your spouse's Social Security number in the respective fields. If you are filing as a composite filer, enter the Employer Identification Number instead.

- Complete the Tax Computation Worksheet provided within the form to determine the balance due. Fill in the amounts for total income tax, use tax, withholdings, estimated payments, and tax credits as required.

- Once you have calculated the balance due, enter this amount on line 6 of the SC4868. Ensure that you are making the payment in full, as extensions do not extend the payment deadline.

- Review your entries for accuracy and completeness. Ensure that all required fields are filled out and no mistakes are present.

- Save the form with your changes. You may choose to download, print, or share your completed SC4868 for your records.

Complete your SC4868 online to ensure a smooth extension process for your tax filing.

Not all states require you to file state taxes; some states do not impose an income tax at all. However, if you reside in a state with income taxes, such as South Carolina, you must file if your income exceeds state thresholds. Make sure to check the specific requirements for your state using US Legal Forms, especially when dealing with Sc4868.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.