Get 355 7004

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 355 7004 online

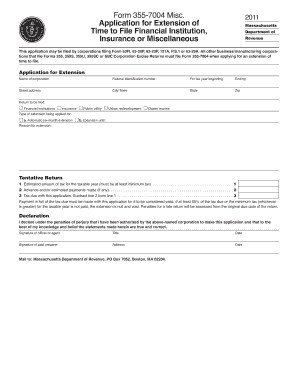

This guide provides clear, step-by-step instructions on completing the 355 7004 form online, designed for users with varying levels of experience. Understanding how to fill out this application for extension of time to file is essential for ensuring compliance and avoiding penalties.

Follow the steps to fill out the 355 7004 form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name of the corporation as it appears on official documents. Ensure accuracy to avoid any complications.

- Enter the federal identification number of the corporation. This number is crucial for identification purposes.

- Specify the tax year by indicating the start and end dates clearly.

- Provide the street address, city or town, state, and zip code of the corporation.

- Indicate the type of return to be filed, selecting one of the following options: financial institutions, insurance, public utility, urban redevelopment, or ocean marine.

- Choose the type of extension being applied for: an automatic six-month extension or an extension until a specified date.

- Explain the reason for the extension request in the designated section.

- Complete the tentative return section by providing the estimated amount of tax for the taxable year, advance or estimated payments made, and calculating the tax due by subtracting line 2 from line 1.

- Ensure full payment of the estimated tax due accompanies the application, as this is required for the application to be valid.

- Review the declaration statement and provide the authorized signature, title, and date. This section must be completed by a treasurer or assistant treasurer of the corporation or an authorized individual.

- If applicable, include the signature and address of the paid preparer, along with the date they completed the form.

- Complete the filing process by saving the changes, downloading, and/or printing the form for your records.

- Mail the completed form to the Massachusetts Department of Revenue at the specified address, ensuring that it is sent in duplicate if a copy is required.

Get started on completing the 355 7004 form online to ensure your application for extension is submitted correctly and timely.

Filing form 7004 involves completing the form and selecting your preferred method of submission. You can file electronically or send a paper form by mail. It is essential to check the deadlines to avoid late filing penalties. If you need assistance with the process, the uslegalforms platform offers valuable resources to simplify your filing experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.