Loading

Get Illinois Rl 26

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Illinois Rl 26 online

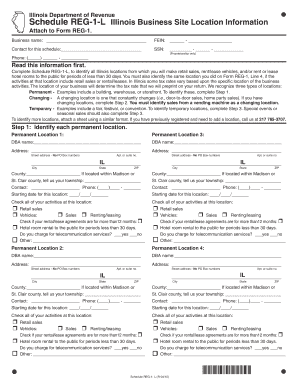

Filling out the Illinois Rl 26 form is essential for identifying all retail sales locations for your business. This guide provides clear and step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Illinois Rl 26 form online

- Press the ‘Get Form’ button to access the Illinois Rl 26 online form. This action will allow you to open the document in the editor, where you can begin completing it.

- In the first section, you need to enter your business name, Federal Employer Identification Number (FEIN), and the contact information for this schedule. For proprietorships, provide your Social Security Number (SSN) and phone number as well.

- Read through the introductory information regarding the purpose of Schedule REG-1-L. Ensure you understand the types of locations you need to report: permanent, changing, and temporary. You will complete different sections of the form based on these categories.

- For permanent locations, fill in the requested information for each applicable location. Ensure to include any Doing Business As (DBA) names, addresses, and dates of operation. Mark all activities at each location, such as retail sales or vehicle rentals.

- For changing locations, enter the information for each changing sales location. Provide the DBA name, municipality, and starting date of operation for each. Mark any relevant activities as needed.

- For temporary locations, fill in the details for temporary sales events such as fairs and festivals. Include the DBA name, address, and dates for starting and ending your operations.

- Once all sections are complete, review your entries for accuracy. You can then save changes to the form, download it for your records, print it, or share it as necessary.

Complete and submit your Illinois Rl 26 form online today to ensure compliance with tax regulations.

Calculating Illinois base income involves determining your total income minus any permissible deductions, such as business expenses or retirement contributions. The Illinois Rl 26 offers insights into tax responsibilities for property owners, which can affect base income calculations. Keep thorough records to make this process easier.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.