Loading

Get Form 9n

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 9n online

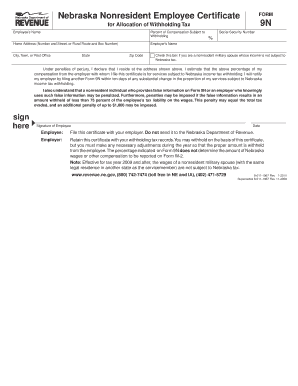

Filling out the Form 9n, or the Nebraska nonresident employee certificate, is a crucial step for nonresident employees to allocate their withholding tax properly. This guide will provide you with step-by-step instructions to complete the form online effectively.

Follow the steps to complete your Form 9n online

- Press the 'Get Form' button to access the Form 9n and open it for editing.

- Enter your full name in the 'Employee’s Name' field to ensure accurate identification.

- Indicate the percentage of your compensation that is subject to withholding tax in the corresponding field, providing a precise percentage to avoid issues.

- Fill in your home address, including the street number, rural route, and box number, so that it is clear where you reside.

- Input your Social Security number in the designated space, ensuring that it matches the documents you provided to your employer.

- Provide your employer's name and the address of the employer, including city, town, or post office, state, and zip code, to help ensure proper processing.

- If applicable, check the box indicating that you are a nonresident military spouse and that your income is not subject to Nebraska tax.

- Sign the form in the signature field, affirming your declaration under penalties of perjury that the information provided is accurate.

- Enter the date of your signature to document when the Form 9n was completed.

- After completing the form, save your changes, download a copy for your records, and share it with your employer. Do not send it to the Nebraska Department of Revenue.

Complete your Form 9n online today to ensure proper tax withholding.

The first line of the W9 form requires you to enter your name as it appears on your tax return. This is crucial for ensuring that all your tax documents are consistent and accurately reflect your identity. If you're submitting the W9 for a business, the business name should be included as well. For detailed examples, consider looking at the guidance provided by Form 9n.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.