Loading

Get Huntington Hsa Rollover Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Huntington Hsa Rollover Form online

The Huntington Hsa Rollover Form is essential for transferring health savings account (HSA) assets. This guide provides clear, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the Huntington Hsa Rollover Form and open it in the digital editing option provided.

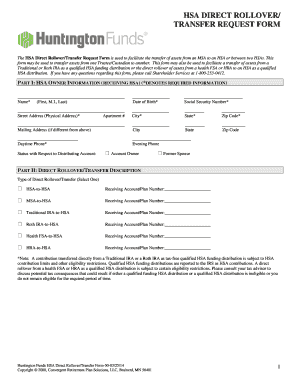

- In Part I, enter your personal information as the receiving HSA owner. Fill in your name, date of birth, Social Security number, address, and phone numbers where indicated. Ensure all required fields are completed.

- Proceed to Part II to select the type of direct rollover or transfer. Choose one of the provided options such as HSA-to-HSA or Traditional IRA-to-HSA, and input the receiving account or plan number associated with your selection.

- If applicable, complete Part III, which is for the account owner information of the distributing account. This section is primarily for cases involving divorce settlements.

- In Part IV, provide details about your current account. Include the name of your current trustee or custodian alongside your current account number and the contact's information.

- Part V asks for transfer or rollover instructions. Specify whether this is a new account or if funds should go to an existing account. List the fund choices and their allocation percentages or amounts.

- In Part VI, outline the liquidation instructions. Decide how you want your assets liquidated and specify the appropriate details for the transaction.

- Review the acknowledgment section in Part VII. By signing, you are certifying the accuracy of your details and understanding your responsibilities regarding eligibility.

- If required, obtain the New Technology Medallion Signature Guarantee Stamp in Part VIII to protect against fraud. Ensure what is needed by contacting your current custodian.

- Finally, follow the mailing instructions in Part IX to submit the completed form. Save any changes, and you may download or print the form for your records before mailing.

Start completing your Huntington Hsa Rollover Form online today for a seamless transfer process.

You can obtain your HSA 5498 form by contacting your HSA custodian. They typically send this form to account holders by mail or make it available online. Ensure that you have the right information ready, and you may reference the Huntington HSA Rollover Form as part of your paperwork if needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.