Get Instructions Form Sft 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions Form Sft 9 online

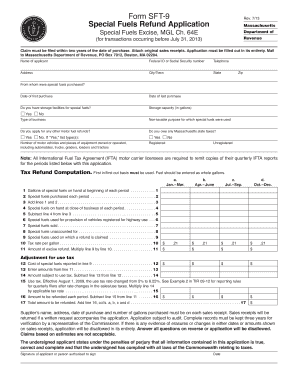

Completing the Instructions Form Sft 9 is a straightforward process that helps users apply for a special fuels refund in Massachusetts. This guide will provide step-by-step instructions to ensure that you fill out the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to obtain the form and open it in an online editor.

- Enter the name of the applicant in the designated field on the form.

- Provide either the Federal ID or Social Security number in the appropriate section.

- Fill in the telephone number followed by the mailing address, including city/town, state, and zip code.

- Indicate from whom the special fuels were purchased by providing the supplier's name.

- Enter the date of the first purchase along with the date of the last purchase of special fuels.

- Specify if you have storage facilities for special fuels by selecting 'Yes' or 'No' and include the storage capacity in gallons.

- Indicate the type of business and state the non-taxable purpose for which the special fuels were used.

- Answer whether you are applying for any other motor fuel refunds and whether you owe any Massachusetts state taxes.

- Report the number of motor vehicles and pieces of equipment owned, including details on their registration status.

- Complete the tax refund computation section using the first in/first out method. Fill in the gallons of special fuels on hand, purchased, sold, and used as specified.

- Fill in the amounts to be refunded and calculate the totals, ensuring all calculations are accurate.

- Sign and date the form to certify that the information provided is true and complete.

- Review all fields for accuracy and completeness before submitting.

- Once everything is complete, save your changes, download the completed form, print it, or share it as needed.

Complete your documents online today to ensure you meet all filing requirements.

To fill a W-9 form, start by providing your personal and business information as required. After that, select your tax classification and include any necessary identification numbers. Completing the form accurately is vital to ensure compliance with tax regulations, and you can consult the Instructions Form Sft 9 for a more detailed walkthrough of the process. If you're unsure about any section, reliable platforms like US Legal Forms can assist you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.