Get Online Dor Ms Form 89 140

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Online Dor Ms Form 89 140 online

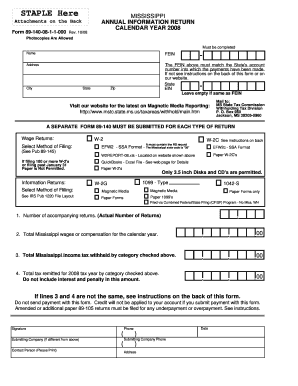

Filling out the Online Dor Ms Form 89 140 is essential for ensuring compliance with Mississippi withholding tax regulations. This guide will provide you with clear, step-by-step instructions on how to accurately complete this form online, making the process straightforward and user-friendly.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to access the Online Dor Ms Form 89 140 and open it in your editing interface.

- Begin by entering your name in the designated field. Ensure that the name matches your business or entity registration.

- Input your Federal Employer Identification Number (FEIN), which must align with the state account number associated with your payments.

- Fill in your address, including city, state, and zip code. Make sure all details are accurate and up to date.

- If applicable, enter your State Employment Identification Number (EIN). Leave this field empty if it is the same as your FEIN.

- Select the method of filing from the options provided, such as W-2, W-2C, or any relevant magnetic media reporting options, ensuring you choose the one that applies to your submission.

- Complete the sections that list the number of accompanying returns and total Mississippi wages or compensation for the calendar year, ensuring the figures are correct.

- Fill in the total Mississippi income tax withheld and the total tax remitted for the tax year 2008, taking care not to include any interest or penalties.

- Sign and date the form, providing contact information for the submitting company if different from the information above.

- Once you have filled out all necessary fields, review your entries for accuracy before saving your changes. You can then download, print, or share the completed form as needed.

Complete your documentation online to ensure timely and accurate processing.

The processing time for a Mississippi tax return typically ranges from 4 to 6 weeks. However, some returns may take longer, especially if there are discrepancies or if additional information is required. By completing your Online Dor Ms Form 89 140 accurately, you can help speed up the processing of your return. Ensure you submit all required documentation for a smoother experience.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.