Loading

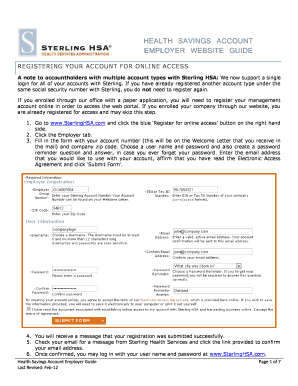

Get A Note To Accountholders With Multiple Account Types With Sterling Hsa We Now Support A Single

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A Note To Accountholders With Multiple Account Types With Sterling HSA We Now Support A Single online

This guide will help you understand how to fill out the form titled 'A Note To Accountholders With Multiple Account Types With Sterling HSA We Now Support A Single.' With clear instructions, you'll be able to complete the form easily and access your accounts online.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to retrieve the form and open it in your preferred editor.

- Carefully read the sections provided in the form to understand the information required.

- Begin filling out your personal information, ensuring that all entries are accurate and complete.

- Input your account information, including any relevant identifiers such as your Social Security number, if applicable.

- Review all the information you have entered for accuracy before proceeding.

- Once satisfied with your entries, you can save changes, download the form, or print it for submission.

Complete your documents online to ensure your account access is seamless and efficient.

You can use money from your HSA to pay for your spouse's medical expenses as long as those expenses fit into the IRS rules. The IRS allows you to use your HSA to pay for eligible expenses for your spouse, children or anyone who is listed as a dependent on your tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.