Loading

Get Idaho Form St 101 Fillable

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Idaho Form St 101 Fillable online

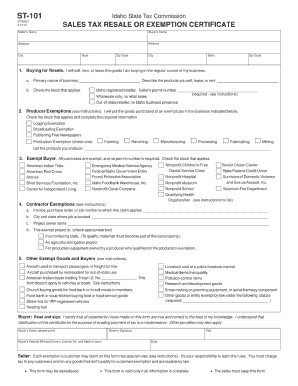

Filling out the Idaho Form St 101 Fillable online is an essential process for those looking to manage their tax exemptions accurately. This guide will walk you through each component of the form, ensuring you understand the requirements and can complete it easily.

Follow the steps to complete your Idaho Form St 101 Fillable online.

- Click ‘Get Form’ button to access the Idaho Form St 101 Fillable and open it in your preferred online editor.

- Begin with Section 1, where you will enter your name, business name, and address. Ensure all the information is accurate and matches your official records.

- Next, move to Section 2. Here, you must indicate your reason for exemption by checking the appropriate box. Provide any additional details requested in this section to clarify your exemption status.

- In Section 3, accurately input your Idaho sales tax permit number. This identification number is crucial for verifying your eligibility for the exemption.

- Proceed to Section 4, where you will select the effective date of your tax exemption. Ensure this date is correctly filled out, as it will impact your tax obligations.

- Finally, review the entire form thoroughly for any errors or missing information. Once you are satisfied, you have the option to save your changes, download the form, print it, or share it with others as needed.

Start completing your documents online today for a smoother filing experience.

In Idaho, individuals and businesses engaged in qualified farming activities may be eligible for farm tax exemptions. To qualify, you typically need to meet specific criteria related to property use and size. Using the Idaho Form St 101 Fillable will allow you to formally apply for these exemptions and enjoy potential savings on your farming operations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.