Loading

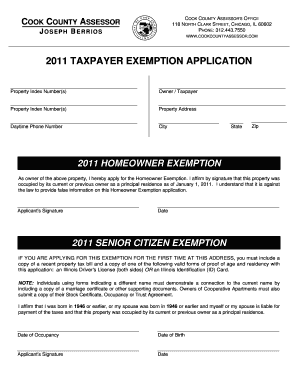

Get 2011 Taxpayer Exemption Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Taxpayer Exemption Application Form online

This guide provides a clear and supportive walkthrough for completing the 2011 Taxpayer Exemption Application Form online. By following these steps, users can effectively fill out the necessary information to apply for tax exemptions confidently.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Start by entering your Property Index Number(s) in the designated field. This is necessary for the local tax authority to identify your property.

- Fill in your name as the Owner/Taxpayer. Ensure that the name matches the one registered with the property records.

- Provide the property address where the exemption is being requested. Double-check for accuracy to avoid processing delays.

- Enter your daytime phone number. This contact detail is important for the taxing authority to reach you if they need further information.

- Indicate your city, state, and ZIP code in the appropriate fields to help verify your property location.

- For the 2011 Homeowner Exemption, affirm that you occupy the property as your principal residence as of January 1, 2011, and provide your signature and the date.

- If applying for the 2011 Senior Citizen Exemption for the first time, attach copies of a recent property tax bill and proof of age/residency, like a valid Illinois Driver's License or ID Card.

- Also, provide one of the required proofs of age and ensure documents linked to previous names are included, such as a marriage certificate.

- Affirm your eligibility by entering your date of birth and the date you occupied the property. Again, sign and date the form.

- Once all fields are filled out correctly, review your application for any missing or incorrect information. Save changes, then download or print the completed form for your records.

- Finally, consider sharing your form with the relevant authorities as required.

Complete your 2011 Taxpayer Exemption Application Form online today!

Choosing to claim 0 or 1 exemption depends on your financial circumstances. Claiming 0 often results in higher tax withholding, which can lead to a larger refund. Conversely, claiming 1 may provide immediate tax benefits, but it could adjust your refund amount. Use the 2011 Taxpayer Exemption Application Form to assess which option aligns with your financial goals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.