Loading

Get Form 9595

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 9595 online

Filling out Form 9595 online can streamline your application process and ensure accuracy. This guide provides step-by-step instructions tailored to users of all levels of experience, simplifying the submission of this important document.

Follow the steps to successfully complete the Form 9595 online.

- Click 'Get Form' button to access the form in your preferred digital format.

- Begin by entering your personal information in the designated fields. This may include your name, contact information, and any other relevant identifiers as requested.

- Proceed to the next section, which may require you to specify the purpose of the form. Make sure to choose the option that best describes your situation.

- Carefully review any additional fields that may require specific details or documentation. If supporting information is needed, gather it ahead of time to ensure a smooth completion.

- Once all fields are filled, review your entries for accuracy. It is important that all information is correct to avoid processing delays.

- Save your changes, then choose whether to download a copy for your records, print it for submission, or share it electronically as required.

Complete your Form 9595 online today to ensure a hassle-free submission process.

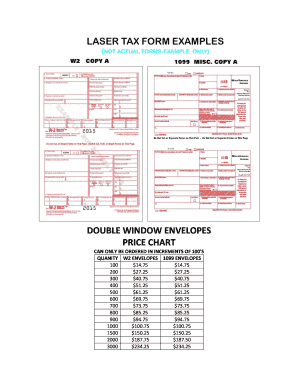

You can print your own 1099 forms, but it’s important to use the official IRS-approved format. Ensure that the form is correctly filled out before printing, as mistakes can lead to penalties. If you don’t have the required forms, filing electronically could be a more efficient alternative. Utilizing resources like uslegalforms can help simplify this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.