Loading

Get Aicpa & Cima Form 709 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AICPA & CIMA Form 709 online

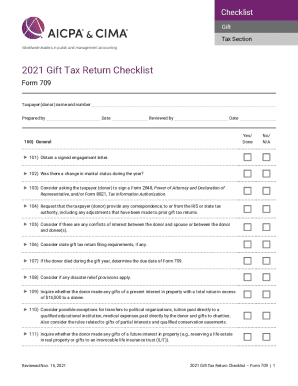

The AICPA & CIMA Form 709 is essential for reporting gifts made during the tax year. This guide provides a clear, step-by-step process to assist you in completing the form online, ensuring accuracy and compliance with tax regulations.

Follow the steps to successfully fill out the AICPA & CIMA Form 709 online.

- Press the ‘Get Form’ button to download the form and open it in your document management system.

- Fill in the taxpayer (donor) name and taxpayer identification number in the designated fields.

- Complete the ‘Prepared by’ section with the name of the individual or firm preparing the form.

- Enter the date of preparation and review in the appropriate fields.

- Answer the questions in the General section (100-134) regarding gifts made and any changes in marital status, as these will influence your filing.

- Move to Schedule A for the computation of taxable gifts, detailing any trusts, property transfers or significant gifts.

- Continue to Schedule B if applicable, filing gifts from prior periods and noting any amendments needed.

- Complete Schedule C if applicable, addressing the Deceased Spouse Unused Exclusion (DSUE) and its implications.

- Fill out Schedule D concerning GST tax, confirming eligibility for annual exclusions and mindful of exemptions.

- Finally, review all the sections carefully for accuracy, save your changes, and prepare to download, print, or share the completed form.

Begin filling out the AICPA & CIMA Form 709 online now for an organized and accurate filing experience.

There is no penalty for late filing a gift tax return (Form 709) if no tax is due. The reference to a "minimum penalty" for failure to file applies to income tax returns (Section 61), not gift tax returns, which are addressed in Section 2501.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.