Get Ncb On W 2 University Of Oklahoma

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ncb On W 2 University Of Oklahoma online

Filling out the Ncb On W 2 form is an essential task for individuals employed by the University of Oklahoma. This guide will provide clear and detailed instruction on how to accurately complete the form, ensuring that all necessary information is correctly entered to facilitate efficient processing.

Follow the steps to effectively complete your W-2 form online.

- Click 'Get Form' button to access the Ncb On W 2 form and open it in the editor.

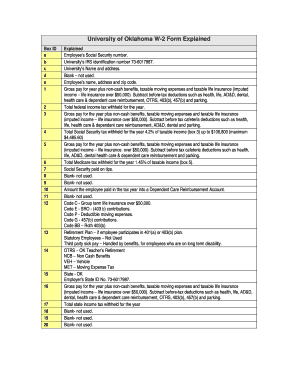

- Enter the employee's Social Security number in Box a to ensure accurate identification for tax purposes.

- Input the University’s IRS identification number (73-6017987) in Box b.

- Fill in the University's name and address in Box c.

- Box d is blank and not used; leave it empty.

- Enter the employee's name, address, and zip code in Box e.

- Complete Box 1 by indicating gross pay for the year, including non-cash benefits, taxable moving expenses, and taxable life insurance. Be sure to subtract any before-tax deductions.

- In Box 2, report the total federal income tax withheld for the year.

- Repeat the gross pay calculation in Box 3 and include any non-cash benefits while excluding cafeteria deductions.

- Fill in Box 4 with the total Social Security tax withheld for the year, calculated at 4.2% of taxable income.

- Provide the gross pay information again in Box 5, following the same criteria as before.

- Enter the total Medicare tax withheld in Box 6, calculated at 1.45% of taxable income.

- If applicable, indicate any Social Security paid on tips in Box 7.

- Leave Box 8 blank, as it is not used.

- Box 9 is also not used; leave it blank.

- Complete Box 10 with the amount the employee paid into a Dependent Care Reimbursement Account during the tax year.

- Boxes 11 through 14 include various codes and should be filled according to the specific circumstances, such as group term life insurance and retirement contributions.

- Boxes 15 and 16 require filing the employer's state ID number and total state income tax withheld, corresponding to the data specified previously.

- After completing all relevant sections of the form, review for accuracy before saving changes, and then proceed to download, print, or share the completed form as necessary.

Complete your Ncb On W 2 form online today for a smooth filing experience.

You might receive a letter from the Oklahoma tax commission for several reasons, including discrepancies in your tax filings or requests for additional information. It is essential to address the letter promptly to avoid further complications. If the letter relates to your W-2 details, such as the Ncb On W 2 University Of Oklahoma, you can find helpful documents and templates on uslegalforms to streamline your response and ensure clarity.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.