Loading

Get Notice Of Non Ohio Domicile For Taxable Year 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notice Of Non Ohio Domicile For Taxable Year 2011 Form online

This guide is designed to assist users in completing the Notice Of Non Ohio Domicile For Taxable Year 2011 Form online. It provides step-by-step instructions to ensure a smooth process while accurately reporting your non-residency status for Ohio tax purposes.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

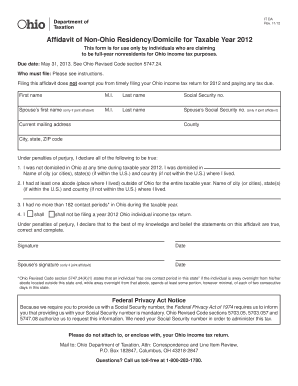

- Begin by entering your first name, middle initial, and last name in the appropriate fields. If you are filing a joint affidavit, also include your partner's information.

- Provide your Social Security number and, if applicable, your partner's Social Security number.

- Fill in your current mailing address, including county, city, state, and ZIP code.

- In the declaration section, confirm that you were not domiciled in Ohio during the taxable year by stating the name of the city or cities, state(s), and country where you resided.

- Indicate the presence of at least one abode outside Ohio for the entire taxable year and specify the location(s).

- State the number of contact periods you had in Ohio during the taxable year, ensuring it does not exceed 182 periods.

- Select whether you will be filing a year 2012 Ohio individual income tax return by checking the appropriate box.

- Affirm the accuracy of your statements by signing and dating the form. If filing jointly, your partner must also sign and date.

- Save your changes, then download, print, or share the completed form as needed.

Complete your forms online today for easier document management.

Yes, Ohio mandates nonresident withholding on employees working in the state. This withholding applies to wages and other compensation earned within Ohio, ensuring the state collects taxes upfront. Knowing this can help you plan better for tax obligations. If you are unsure about withholding requirements, the Notice Of Non Ohio Domicile For Taxable Year 2011 Form can guide you through the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.