Loading

Get Virginia Dft 1 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia Dft 1 Form online

Filling out the Virginia Dft 1 Form online is a straightforward process designed for registered distributors of motor vehicle fuel. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the Virginia Dft 1 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the appropriate editor.

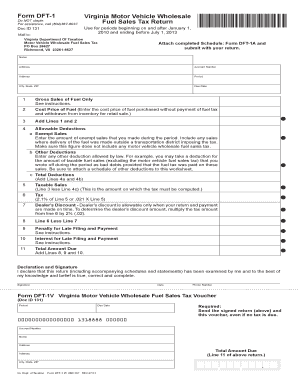

- Enter your name and address in the designated fields at the top of the form. Include your account number and the period for which you are filing.

- Fill in the gross sales of fuel only in the first field. Ensure you calculate this amount accurately by reviewing your sales records.

- Provide the cost price of fuel without the fuel tax in the second field. This should include only fuel intended for retail sale.

- Add the amounts entered in lines 1 and 2 to provide the total in line 3.

- Move on to the allowable deductions. In line 4a, enter the amount of exempt sales made during the period. This includes sales where delivery occurred outside a transportation district imposing the tax.

- In line 4b, list any other deductions permitted by law, like bad debt allowances for taxable fuel sales. Make sure to attach a detailed schedule of these deductions.

- Calculate total deductions in line 4c by adding lines 4a and 4b.

- Determine your taxable sales in line 5 by subtracting total deductions from line 3.

- Calculate the tax due in line 6 by applying the tax rate of 2.1% to the taxable sales amount from line 5.

- In line 7, calculate the dealer's discount, which is 2% of the tax amount from line 6, but only if the return and payment are submitted on time.

- Calculate the amount due in line 8 by subtracting the dealer's discount from the tax amount in line 6.

- If applicable, enter any penalties for late filing or payments in line 9, and interest in line 10 as instructed.

- Add lines 8, 9, and 10 in line 11 to determine the total amount due.

- Complete the declaration section by signing and dating the form. Include a phone number for any follow-up inquiries.

- Once all sections are completed, save your changes, and then download or print the form to submit by mail.

Complete and file your Virginia Dft 1 Form online today to ensure compliance and ease in tax management.

Yes, it is generally required to attach your W-2 to your Virginia state tax return. This form provides the state with proof of your income and withholding amounts. Utilizing USLegalForms can help ensure that you incorporate your W-2 correctly when you submit your Virginia Dft 1 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.