Loading

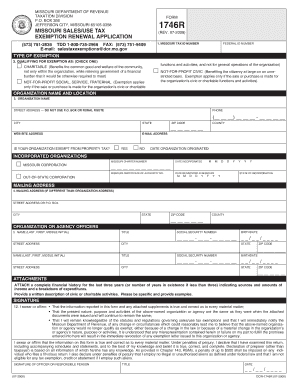

Get Form 1746r

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1746r online

Filling out Form 1746r, the Missouri sales/use tax exemption renewal application, can seem daunting. However, this guide provides step-by-step instructions to help you successfully complete the form online, ensuring you provide all necessary information accurately and efficiently.

Follow the steps to complete the form seamlessly.

- Press the ‘Get Form’ button to access the form and open it in your online editor.

- Enter your Missouri tax ID number in the designated field at the beginning of the form.

- Fill in your federal ID number, which is required for identification.

- Select the type of exemption you are qualifying for by checking the appropriate box: Charitable, Not-for-profit civic, or Not-for-profit social, service, fraternal.

- Provide the name and location of your organization, ensuring to include the full street address without using a P.O. Box.

- Enter the contact information for your organization, including phone number, website address, e-mail address, and decide if your organization is exempt from property tax.

- Indicate the date your organization was originated and fill out additional details if it is incorporated, including Missouri charter number and date incorporated.

- If applicable, provide your out-of-state corporation details such as state of incorporation and date registered in Missouri.

- If your mailing address is different from your organization address, complete the mailing address section.

- List the names, titles, social security numbers, and addresses of your organization or agency officers as required.

- Prepare your attachments, including a complete financial history for the last three years and a written description of civic or charitable activities.

- Sign and date the declaration at the end of the form, affirming that the information provided is true and correct.

Complete your Form 1746r online today to ensure your organization's tax exemption status!

To file an extension for Missouri state taxes, complete Form 4868 or the designated business extension form, and submit it by the deadline. It’s crucial to ensure that your extension request is filed accurately to avoid penalties. Using Form 1746r can simplify this process and help you manage your state tax obligations seamlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.