Loading

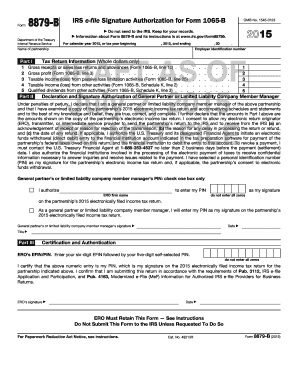

Get Gross Profit (form 1065-b, Line 3)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gross Profit (Form 1065-B, Line 3) online

Filling out the Gross Profit section on Form 1065-B can be straightforward with the right guidance. This step-by-step guide will provide you with clear instructions to ensure accurate completion of this important form.

Follow the steps to fill out the Gross Profit section accurately.

- Click ‘Get Form’ button to obtain the form and open it in the document management editor.

- Locate the line labeled 'Gross profit (Form 1065-B, line 3).' This section requires you to enter the gross profit amount, which can be calculated by subtracting returns and allowances from gross receipts or sales. Ensure the amount is represented in whole dollars only.

- Double-check the figure entered for accuracy. It's essential to verify that all calculations correlate with the details provided in your income statement before moving forward.

- After filling out the Gross Profit section, review the entire form for any possible errors or omissions to ensure completeness.

- Once you are confident that all information is complete and accurate, proceed to save, download, print, or share the form as needed.

Take the next step and complete your documents online for a seamless filing process.

Your total (or “gross”) income for the tax year, minus certain adjustments you're allowed to take. Adjustments include deductions for conventional IRA contributions, student loan interest, and more. Adjusted gross income appears on IRS Form 1040, line 11.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.