Get Douglas County Kansas - W-9 Form ( Pdf Format)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Douglas County Kansas - W-9 Form (PDF Format) online

Filling out the Douglas County Kansas - W-9 Form online can streamline the process of providing your taxpayer identification information. This guide offers clear instructions on how to complete the form effectively, ensuring compliance with tax requirements.

Follow the steps to fill out the W-9 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name exactly as it appears on your income tax return in the designated field. Ensure that any name changes are accurately reflected.

- If your business name differs from your personal name, enter it in the business name field.

- Select the appropriate box based on your status: Individual/Sole proprietor, Corporation, Partnership, Limited liability company (and specify the tax classification), or Other.

- Fill out your address, including the street number, street name, apartment or suite number, if applicable, followed by your city, state, and ZIP code.

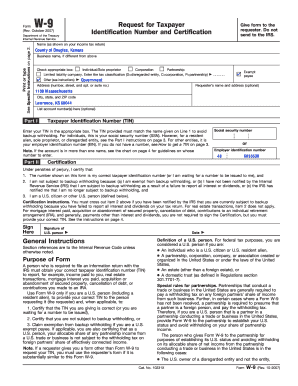

- In Part I, provide your Taxpayer Identification Number (TIN), either your Social Security Number (SSN) for individuals or your Employer Identification Number (EIN) for entities. Ensure the TIN matches the name provided earlier to avoid backup withholding.

- Moving to Part II, read the certification statement carefully. Check the appropriate boxes confirming your taxpayer identification number is correct, and specify your eligibility relative to backup withholding.

- Sign the form where indicated, ensuring that your signature is legible and matches the name provided earlier. Include the date of signing.

- Once completed, review your entries for accuracy. Save changes to your document, and download or print the form to share it with the requester. Do not send it to the IRS.

Complete your W-9 Form online today to streamline your tax documentation process.

Related links form

Yes, you should fill out your own Douglas County Kansas - W-9 Form (PDF Format). The form is designed for you to provide your information directly, ensuring that the IRS has accurate records of your taxpayer identification details. If needed, consider using platforms like uslegalforms to ensure that your form is filled out correctly and submitted without error.

Fill Douglas County Kansas - W-9 Form ( PDF Format)

Enter your name as shown on required U.S. federal tax documents on line 1. The W-9 is an IRS form requesting official information about a vendor. Give form to the requester. Do not send to the IRS. Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS. An individual or entity (Form W-9 requester) who is required to file an information return with the IRS is giving you this form because they. Under penalties of perjury, I certify that: 1. KLT permanently protects. Kansas lands of ecological or agricultural importance or lands of historic, scenic, and recreational merit. If you are providing Form W-9 to an FFI to document a joint account, each holder of the account that is a U.S. person must provide a Form W-9.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.