Loading

Get State Hawaii Form G 17

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Hawaii Form G 17 online

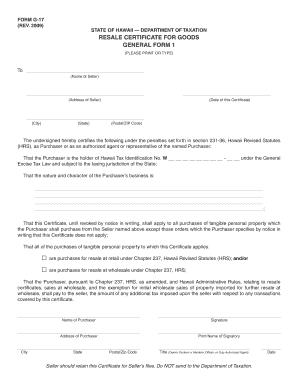

This guide provides comprehensive instructions on filling out the State Hawaii Form G 17 online. Designed for convenience and accuracy, this form serves as a resale certificate for goods in Hawaii.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of the seller in the designated field. Ensure that the spelling is accurate to prevent any issues with the certificate.

- Next, input the seller's address, including the city, state, and postal or ZIP code. Carefully check that this information is complete and correctly formatted.

- In the date field, enter the date you are completing this certificate. This should be formatted correctly to avoid any confusion.

- As the purchaser or authorized agent, certify your Hawaii Tax Identification Number in the specified section. This number is essential for tax jurisdiction validation.

- Describe the nature and character of your business in the provided space. Provide clear and brief information relevant to your operation.

- Indicate the types of purchases by checking the appropriate boxes for purchases for resale at retail and/or wholesale. Ensure your selections align with your business operations.

- Review the terms of the certificate carefully. Acknowledge your responsibility to inform the seller in writing if the certificate does not apply to specific purchases.

- Complete the purchaser's name and address fields. This provides identification for the entity claiming the exemption.

- Include your signature and print your name. Make sure that the title reflects your role accurately (e.g., owner, partner, agent).

- After completing the form, save your changes. You may choose to download, print, or share a copy of the completed form as necessary.

Complete your State Hawaii Form G 17 online smoothly and accurately today.

Hawaii tax deadlines vary, but generally, businesses must file their GE tax returns by the end of the month following the reporting period. For those filing quarterly, the due dates can be a bit different, so check your specific requirements. It’s essential to adhere to these deadlines to avoid incurring penalties. Utilizing platforms like USLegalForms can help you track important dates for filing the State Hawaii Form G 17 and other tax-related deadlines.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.