Loading

Get Understanding Clergy W-2 Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Understanding Clergy W-2 Forms online

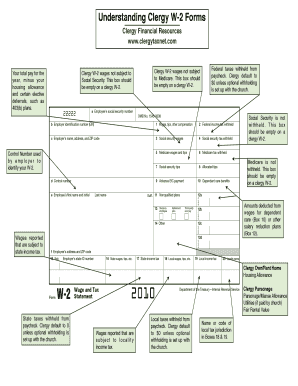

Filling out the Understanding Clergy W-2 Form can seem complex, but with clear guidance, you can complete it accurately online. This form is essential for clergy members to report their earnings and any applicable allowances.

Follow the steps to accurately fill out your Clergy W-2 Form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, report your total pay for the year, which should reflect your earnings after subtracting your housing allowance and any elective deferrals, such as contributions to a 403(b) plan.

- Ensure that the boxes indicating clergy W-2 wages not subject to Social Security and Medicare remain empty, as these should not apply to your status.

- Input any federal taxes withheld from your paycheck. Clergy typically have a default withholding of $0 unless you have set up optional withholding with your church.

- Confirm that Social Security and Medicare boxes are blank, as these are not applicable for clergy members.

- If you have used dependent care deductions or other salary reduction plans, appropriately enter those amounts into the relevant boxes (Box 10 for dependent care and Box 12 for other plans).

- Record any wages subject to state income tax and ensure to note any state taxes withheld, which defaults also to $0 unless you've established optional withholding.

- If applicable, input wages that are reported for locality income tax, and make sure to note local taxes withheld, with a typical default of $0.

- Finally, review all the information you have entered for accuracy. Once confirmed, you can save the changes, download, print, or share the form as needed.

Start filling out your Clergy W-2 Forms online today to ensure accurate tax reporting.

Related links form

More In File. For services in the exercise of the ministry, members of the clergy receive a Form W-2 but do not have social security or Medicare taxes withheld. They must pay social security and Medicare by filing Schedule SE (Form 1040), Self-Employment Tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.