Loading

Get Ky Form 001 Fy Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ky Form 001 Fy Instructions online

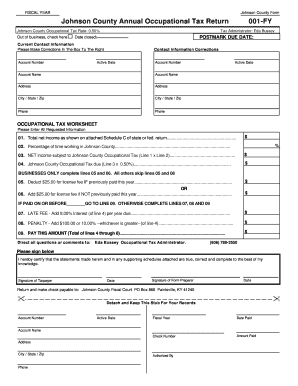

This guide provides a comprehensive overview of how to complete the Ky Form 001 Fy Instructions online. The form is essential for reporting occupational tax in Johnson County and ensuring compliance with local tax regulations.

Follow the steps to complete your form accurately and efficiently.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin by reviewing the header section, ensuring that your account number is accurate. If corrections are needed, please make them in the box provided.

- In the 'Current Contact Information' section, fill out your account name, address, city, state, zip code, and phone number. Ensure this information is up to date.

- For the 'Occupational Tax Worksheet,' enter your total net income as reported on your attached Schedule C from your state or federal return in Line 1.

- On Line 2, indicate the percentage of time you have worked in Johnson County during the fiscal year.

- Multiply the income from Line 1 by the percentage from Line 2 to calculate your net income subject to Johnson County Occupational Tax. Enter this calculation in Line 3.

- Next, compute the tax due on Line 4 by multiplying the amount from Line 3 by the tax rate of 0.50%.

- If applicable, complete Lines 5 and 6 regarding the license fee based on your payment status this year.

- If you have not paid by the due date, fill in Lines 7 and 8 regarding any late fees and penalties.

- Finally, calculate the total amount due in Line 9 by summing the amounts from Lines 4 through 8.

- Before submission, review all entries for accuracy. Once confirmed, save your changes, and proceed to download, print, or share the completed form as needed.

Complete your Ky Form 001 Fy online today to ensure timely tax compliance.

Related links form

Kentucky form PTE must be filed by partnerships and pass-through entities doing business in Kentucky. This includes partnerships that have income derived from Kentucky sources. To understand the specific criteria for filing, it’s beneficial to consult the Ky Form 001 Fy Instructions for clear guidelines. If you operate a business that meets these conditions, ensure you comply with the filing requirements to avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.