Get 150 211 055 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 150 211 055 Form online

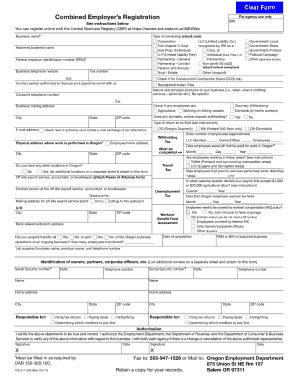

Filling out the 150 211 055 Form online can streamline your application process and save you time. This guide provides clear, step-by-step instructions on how to accurately complete each section of the form, ensuring that all necessary information is included.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to access the form and open it in the online editor.

- Review the form’s introduction section, which provides important information about its purpose and instructions for filing.

- Begin filling out the personal information section, including your name, address, and contact details. Ensure that all entries are accurate and up-to-date.

- Next, complete the eligibility section by answering any questions regarding your qualifications. Read each question carefully to provide the correct information.

- Fill in the required details in the financial information section, including any relevant income or asset data. Make sure your figures are correct.

- Review any additional documentation needed as specified in the form. Gather documents to support your application if required.

- Once all sections are complete, thoroughly review your entries for completeness and accuracy. Make any necessary corrections.

- After verifying all information, save your progress to ensure that no data is lost. You can also choose to download, print, or share the completed form as needed.

Start completing your 150 211 055 Form online today for a smoother application experience.

To become an employer in Oregon, you must first register your business with the Oregon Secretary of State and obtain an Employer Identification Number (EIN) from the IRS. Next, familiarize yourself with state employment laws, including payroll tax responsibilities and employee rights. Additionally, consider using tools like the 150 211 055 Form to ensure compliance with tax reporting requirements. Taking these steps will help you establish and maintain a successful business.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.