Loading

Get It203x 2011 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It203x 2011 Form online

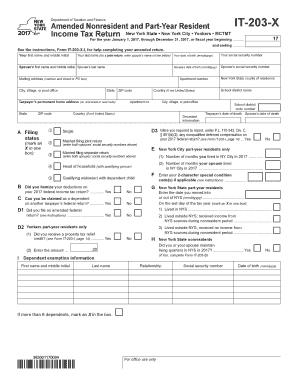

Filling out the It203x 2011 Form online can simplify the process of amending your New York State tax return. This guide provides thorough, step-by-step instructions to help users complete the form efficiently, ensuring all necessary information is accurately captured.

Follow the steps to complete your It203x 2011 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information. This includes your first name, middle initial, last name, date of birth, and your spouse’s details if applicable. Make sure to double-check the information for accuracy.

- Complete the mailing address section. This consists of your street address, apartment number if applicable, city, state, and ZIP code. If your permanent home address differs from your mailing address, make sure to include that as well.

- Next, indicate your filing status by marking an X in the appropriate box. Choices include single, married filing jointly, married filing separately, head of household, and qualifying widow(er).

- Indicate whether you itemized deductions on your 2017 federal income tax return by selecting yes or no.

- Answer whether you can be claimed as a dependent on someone else’s federal return. Choose yes or no.

- Provide information about any amended federal return you have filed by selecting yes or no.

- If you are a part-year resident of Yonkers, indicate whether you received a property tax relief credit.

- In the nonresident sections, indicate if you or your spouse maintained living quarters in New York State during 2017.

- Continue filling in your income and adjustments in the relevant fields, ensuring you enter whole dollar amounts only.

- Complete the section regarding standard or itemized deductions, entering the appropriate amount based on your filing situation.

- Calculate your New York taxable income by following the guidance provided on the form.

- Proceed to fill out tax computation, credits, and any additional taxes applicable to your situation.

- Finally, review all entered information for accuracy before saving your changes. Choose to download, print, or share the completed form as needed.

Complete your It203x 2011 Form online today for a smoother tax amendment process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You certainly can paper file your NY state return, including the It203x 2011 Form. Just be sure to follow the required procedures when mailing your return to avoid any delays. Remember that using online resources can help ease this process. Uslegalforms offers tools and advice to assist you in filing efficiently.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.