Loading

Get Form G-45 Periodic General Excise/use Tax Return, Rev ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form G-45 Periodic General Excise/Use Tax Return online

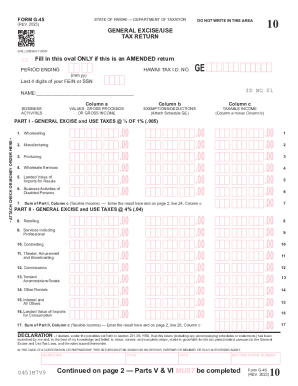

Filing the Form G-45 Periodic General Excise/Use Tax Return is essential for reporting general excise and use taxes in Hawaii. This guide provides a clear, step-by-step approach to completing the form online, ensuring that all users can efficiently navigate the process.

Follow the steps to fill out the Form G-45 online.

- Press the ‘Get Form’ button to access the form and open it in your document editor.

- Fill in the period ending date and provide your Hawaii Tax Identification Number.

- Enter your business name in the designated field.

- For each type of business activity listed in Part I and Part II, input the appropriate values in Column a, including gross proceeds or gross income.

- Deduct any exemptions or deductions applicable to your business activities and enter these figures in Column b.

- Calculate your taxable income by subtracting Column b from Column a, and enter the result in Column c for both Parts I and II.

- Inside Part III, report any insurance commissions earned with the corresponding values in the designated columns.

- For the county surcharge section, enter amounts from Part II based on the respective county rates.

- Complete the Schedule of Assignment of Taxes by District in Part V, ensuring to select the appropriate taxation district.

- In Part VI, compile total amounts from your previous parts to complete your periodic return.

- Review all entered data for accuracy and completeness.

- Save your changes, then download the completed form for your records. You may also print or share the form as needed.

Complete your Form G-45 online today to ensure compliance with Hawaii tax regulations.

Option 1: Sign into your eFile.com account, modify your Return and download/print the HI Form N-11 (residents) or N-15 (nonresidents and part-year residents) under My Account. Check the "Amended Return" box, sign the form, and mail it to one of the addresses listed below.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.