Loading

Get Nycgovdeferredcomp Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nycgovdeferredcomp Form online

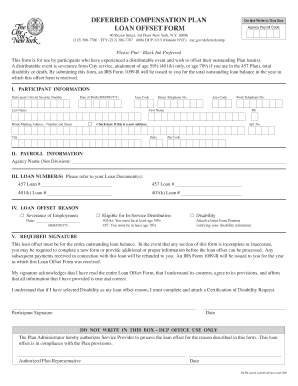

Filling out the Nycgovdeferredcomp Form online is crucial for participants wishing to offset their outstanding loans due to a distributable event. This guide provides a step-by-step approach to help you complete the form accurately.

Follow the steps to complete the form effortlessly.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by providing your participant information. Enter your Social Security number, date of birth in MM/DD/YY format, and your last and first names. Include your home and work telephone numbers along with your home mailing address. If this is a new address, be sure to check the appropriate box.

- In the payroll information section, specify the agency name, making sure to list the agency rather than the division.

- Refer to your Loan Document(s) to enter the loan numbers for both the 457 and 401(k) plans. Ensure you list all relevant loan numbers accurately.

- Select the reason for the loan offset from the options provided: severance of employment, eligible for in-service distribution, or disability. If applicable, attach the necessary documentation that verifies your disability retirement.

- In the required signature section, review all the information you have provided to ensure accuracy. Sign and date the form to affirm that you understand its contents and agree to its provisions.

- Once you have completed the form, you may save your changes, download a copy for your records, print it, or share it as needed.

Complete your Nycgovdeferredcomp Form online today to ensure your loan offset is processed promptly.

Deferred compensation in NYC is a retirement savings plan that allows employees to set aside a portion of their income before taxes. This plan helps to grow your savings for retirement while potentially reducing your taxable income. If you want to learn more about how this works, explore information related to the Nycgovdeferredcomp Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.