Get Tp 215 Fill In Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tp 215 Fill In Form online

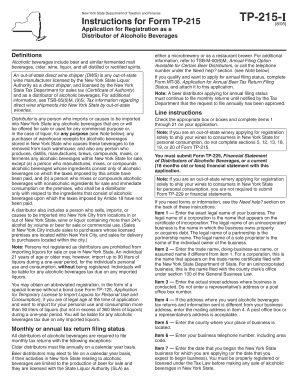

Filling out the Tp 215 Fill In Form is an essential step for individuals or businesses looking to register as distributors of alcoholic beverages in New York State. This guide provides clear, step-by-step instructions to help you accurately complete the form online.

Follow the steps to successfully complete the Tp 215 Fill In Form online.

- Press the ‘Get Form’ button to access the comprehensive Tp 215 Fill In Form and open it for editing.

- Begin by entering your business's exact legal name in the designated field. This should match the name on your incorporation certificate or business documents.

- Input the trade name or doing-business-as name if it differs from the legal name. Make sure this name is properly registered with the appropriate authority.

- Provide the actual street address where your business operates. Avoid using a representative's address or a post office box number.

- If the address for tax return correspondence is different, fill in the mailing address in the specified section. A post office box is acceptable here.

- Indicate the county where your business is located.

- Enter your business telephone number, including the area code.

- Specify the date when your New York State business commenced or is expected to commence.

- Fill in your federal employer identification number (EIN); if you do not have one, indicate N/A.

- If applicable, enter a second EIN in the following field, or state N/A.

- Select the type of business organization that corresponds to your business structure.

- Provide required information for all key individuals and stakeholders involved in the business, following the outlined instructions.

- Additionally, indicate the percentage of voting stock held by shareholders not listed previously.

- List the names and addresses of banking institutions your business uses for financial transactions.

- Confirm your registration as a sales tax vendor, as this application will not be accepted without it. Include Form DTF-17 if registering.

- Ensure you have a valid license from the State Liquor Authority; the application cannot be processed without one.

- Mark the relevant boxes indicating the types of alcohol distribution for which you possess an SLA license.

- List each of your alcoholic beverage suppliers with their complete names and addresses.

- Estimate the monthly quantity of beverages you expect to sell.

- Answer whether you have any other business interests or affiliations related to alcoholic beverages.

- Confirm your understanding of the information provided by answering yes or no to the final inquiry.

- After completing all fields, ensure the form is signed by the responsible party, as unsigned forms will be returned. Save your changes and proceed to download, print, or share as necessary.

Complete your Tp 215 Fill In Form online today to ensure compliance and facilitate your distribution process.

Yes, New York City’s combined sales tax rate is currently 8.87 percent, which includes state and local taxes. It's important to consider this rate when purchasing liquor, as it applies to many retail transactions. Utilizing the Tp 215 Fill In Form can help you keep track of your purchases, including sales tax calculations, making tax time easier. This form offers a structured way to manage your records, ensuring you meet all necessary tax requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.