Loading

Get Nys Tax Refund Mt 151 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nys Tax Refund Mt 151 Form online

Filling out the Nys Tax Refund Mt 151 Form online can seem daunting, but understanding its components makes the process manageable. This guide provides step-by-step instructions for each section of the form, ensuring users can complete it with confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

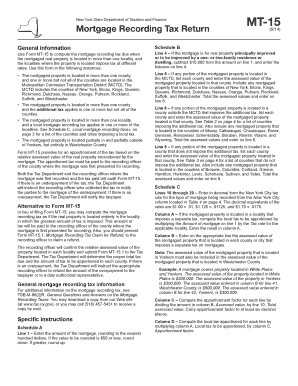

- Enter the name of the mortgagee at the designated field at the top of the form. This is the individual or entity that is lending the money secured by the mortgage.

- Input the amount of the mortgage, ensuring to round to the nearest hundred dollars. Use proper rounding rules when determining the final number.

- Fill in the name of the mortgagor, which is the individual or entity borrowing the funds and securing the mortgage.

- Provide the mailing address of the mortgagor, including city, state, and ZIP code, as this information is crucial for correspondence.

- Record the date of the mortgage in the appropriate field. This date marks when the mortgage agreement was formalized.

- Complete Schedule A by calculating Basic Tax and Special Additional Tax based on the rounded mortgage amount. Use the provided formulas in the form.

- Proceed to Schedule B to assess if any portion of the mortgaged property is located within specified counties. If applicable, list the counties and their assessed values per the guidelines.

- Fill out Schedule C, where you will enter applicable local tax rates per locality. Ensure you compute the tax as instructed, using the form's tables for accurate rates.

- Review and confirm all entered information for accuracy. It is important to ensure all calculations are correct to avoid issues with state tax authorities.

- Once completed, save the changes made to the form. You can then download, print, or share the form as necessary for your records or submission.

Start filling out your Nys Tax Refund Mt 151 Form online today to ensure a smooth submission process.

To claim your tax refund, you need to complete the Nys Tax Refund Mt 151 Form. Ensure you have all necessary documentation, such as your W-2s and any other relevant tax forms. After completing the form, submit it to the New York State Department of Taxation and Finance. Consider using USLegalForms to access the form quickly and easily, ensuring a smooth refund process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.