Loading

Get Form 783

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 783 online

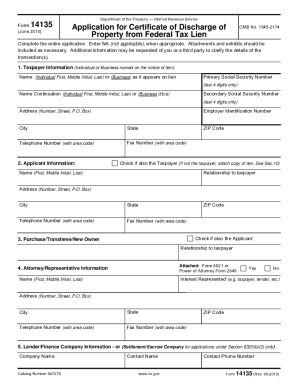

Filling out the Form 783 online for a Certificate of Discharge from Federal Tax Lien can seem daunting, but with careful guidance, the process becomes straightforward. This guide provides a step-by-step approach to ensure you complete each section accurately and efficiently.

Follow the steps to successfully complete Form 783 online.

- Press the ‘Get Form’ button to obtain the form and open it in your editor.

- Complete Section 1, which requests taxpayer information. Enter the name, address, and last four digits of the Social Security Number or Employer Identification Number as listed on the Notice of Federal Tax Lien.

- In Section 2, check the appropriate box if you are the taxpayer. Provide your relationship to the taxpayer and, if needed, your contact details.

- For Section 3, check the box if you are the purchaser. If applicable, fill in the new owner's relationship to the taxpayer.

- Section 4 allows you to provide information about your attorney or representative if applicable. If not using a representative, enter 'NA'.

- Move to Section 5 to input information regarding the lender or finance company involved in the transaction.

- In Section 6, indicate the proposed sales price and the expected proceeds that will be paid to the IRS in exchange for the discharge.

- Select the appropriate box in Section 7 that corresponds to the basis for discharge under the Internal Revenue Code.

- Detail the property description in Section 8, including whether it is real or personal property, its location, and attach necessary documents.

- Complete Section 9 by indicating whether you have attached the required appraisal and any additional valuations.

- Fill out Sections 10 to 14 with any necessary supplementary information, attachments, or documents as specified.

- In Section 15, check if you are submitting an escrow agreement if your application is under the appropriate code provision.

- Review the waiver options in Section 16, especially if you are applying as a property owner who is not the taxpayer.

- Finally, sign and date the declaration in Section 17, confirming the truth and accuracy of the information provided.

- Once you are satisfied with the completed form, save your changes, and download or print it for submission.

Start completing your documents online today to ensure a smooth application process.

To apply for a certificate of discharge from a federal tax lien, complete Form 783 accurately. This process involves demonstrating that the tax liability has been met. Utilizing services like US Legal Forms can help you navigate this application smoothly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.