Get Mi W 4p Form 09 11

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi W-4P Form 09 11 online

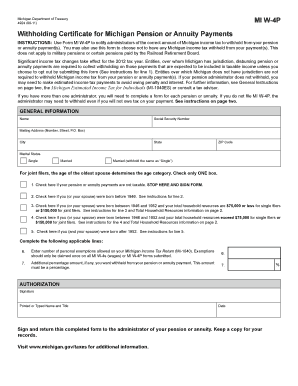

Filling out the Mi W-4P Form 09 11 online is a straightforward process that allows you to specify the correct amount of Michigan income tax to be withheld from your pension or annuity payments. This guide provides clear, step-by-step instructions to help users complete this form accurately and efficiently.

Follow the steps to complete the Mi W-4P Form online.

- Click ‘Get Form’ button to obtain the form and open it in your online editor.

- Enter your personal information including your name, Social Security number, and mailing address. Ensure that you fill in every required field accurately.

- Select your marital status by checking the appropriate box: Single, Married, or Married (withhold the same as 'Single'). Only check one box.

- Determine if your pension or annuity payments are taxable. Check the appropriate box based on your situation, following the instructions provided for each line.

- Complete line 6 by entering the number of personal exemptions you are allowed on your Michigan income tax return. Remember to claim exemptions only once across all forms.

- If you wish to withhold an additional percentage from your pension or annuity payment, enter that percentage in line 7.

- Sign the form in the designated area and print or type your name and title. Ensure the date is filled out as well.

- Once completed, save your changes and download the form. You can also print a copy or share it as necessary.

Complete your Mi W-4P Form online today to ensure proper tax withholding from your pension or annuity payments.

You can easily obtain Michigan tax forms through the Michigan Department of Treasury's official website. In addition, you can access the Mi W 4p Form 09 11 directly from various online resources. Websites like US Legal Forms provide a straightforward way to download necessary forms without any hassle. Always ensure you have the latest version to meet your filing requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.