Loading

Get Rev Rul 2003 12

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rev Rul 2003 12 online

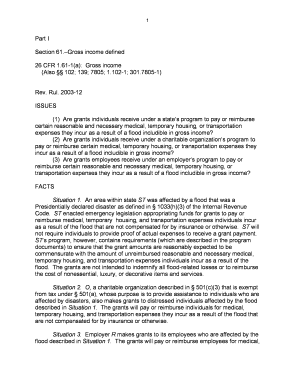

This guide provides clear instructions for filling out the Rev Rul 2003 12, focusing on the reporting of various grants and payments received as a result of a flood scenario. Users will find a user-friendly approach to ensure accurate completion of this important tax form.

Follow the steps to successfully complete Rev Rul 2003 12 online.

- Press the ‘Get Form’ button to access the Rev Rul 2003 12 form. This action will allow you to open the form and start completing it.

- Begin by entering your personal information where indicated, including your name, address, and taxpayer identification number. Ensure this information is accurate to avoid issues in processing.

- Review the sections regarding the types of grants received. Carefully indicate whether the payments are from a state program, charity, or employer.

- Provide details about the amounts received under each category of grants, ensuring they correspond to the expenses you incurred, such as medical, housing, or transportation costs resulting from the flood.

- Refer to the specific instructions for the general welfare exclusion and qualified disaster relief payments to determine if any amounts are exempt from gross income.

- After filling in all required fields, review the completed form for accuracy and completeness. This is crucial to ensure all necessary information is properly represented.

- Once satisfied with your entries, save your changes, download the form for your records, and if needed, print or share it as required.

Get started on completing your Rev Rul 2003 12 form online today for seamless document management.

Related links form

Rev Rul 67 257 deals with the tax implications of certain business expenses. It lays out guidelines for deducting these expenses, which are vital for maintaining proper accounting practices. Incorporating the insights from Rev Rul 2003 12 can further enhance your understanding of how these rulings interact with each other, ensuring you follow tax laws effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.