Loading

Get Irs 1041-qft 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041-QFT online

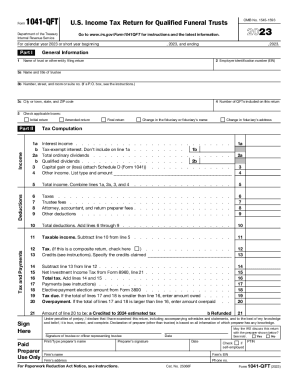

Filling out the IRS 1041-QFT form is an important step in managing a qualified funeral trust's tax obligations. This guide provides clear, step-by-step instructions to help users navigate the form effectively, even with minimal legal experience.

Follow the steps to fill out your IRS 1041-QFT online with ease.

- Click the ‘Get Form’ button to access the IRS 1041-QFT form and open it in your document editor.

- Input the employer identification number (EIN) in the designated field. This is a unique identifier for your trust.

- Enter the name of the trust or other entity filing the return.

- In section 3a, provide the name and title of the trustee responsible for the trust.

- Complete section 3b by entering the street address, including the room or suite number if applicable.

- In section 3c, fill in the city, state, and ZIP code of the trust.

- Select the appropriate checkbox in section 5 to indicate whether this is an initial return, amended return, final return, or if there is a change in fiduciary or fiduciary information.

- Proceed to Part II, where you will report the tax computation. Input all relevant income amounts such as interest income, dividends, and capital gains.

- Continue by calculating the total income by combining the amounts from lines 1a, 2a, 3, and 4.

- In the deductions section, enter any applicable deductions such as trustee fees and other expenses.

- Calculate the total deductions by adding all relevant amounts from lines 6 through 9.

- Determine the taxable income by subtracting the total deductions from the total income.

- Complete the tax calculations, credits, and payments in the respective sections, ensuring all figures are accurate.

- Finalize your form by taking a moment to review all entries for accuracy and completeness.

- Once satisfied, save your changes, and proceed to download, print, or share the completed form as required.

Start filling out your IRS 1041-QFT online today to ensure timely and accurate tax compliance.

If the estate generates more than $600 in annual gross income, you are required to file Form 1041, U.S. Income Tax Return for Estates and Trusts. An estate may also need to pay quarterly estimated taxes. See Form 1041 instructions for information on when to file quarterly estimated taxes.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.