Get Ira Contributions 1991 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ira Contributions 1991 Form online

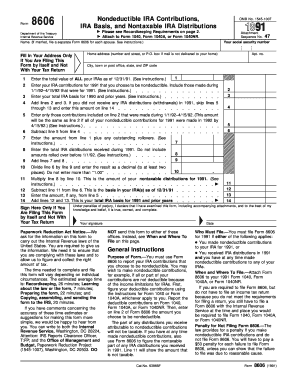

Filling out the Ira Contributions 1991 Form online can streamline your reporting of nondeductible IRA contributions and distributions. This comprehensive guide will walk you through each section, ensuring you understand the requirements and complete the form accurately.

Follow the steps to complete the Ira Contributions 1991 Form effectively.

- Press the ‘Get Form’ button to access the Ira Contributions 1991 Form and open it in a compatible editor.

- Enter your name and social security number in the designated fields at the top of the form. If you are filing a joint return, include your partner's information as necessary.

- In line 1, input the total value of all your IRAs as of 12/31/91, based on statements you received for each IRA.

- For line 2, specify the amount of nondeductible IRA contributions you are reporting for 1991. If applicable, include contributions made from 1/1/92 to 4/15/92 that apply to 1991.

- Complete line 3 with your total IRA basis for the years 1990 and prior. Refer to previous Form 8606s for accuracy if you filed in those years.

- Add the amounts from lines 2 and 3 to enter on line 4. If you did not receive any distributions in 1991, skip to line 14.

- If you made contributions for 1991 and 1992, input relevant amounts in line 5 based on your choices for nondeductible versus deductible contributions.

- Line 6 requires you to calculate the basis of your IRA as of 12/31/91. Ensure that any amounts from line 5 are subtracted from line 4 before filling this in.

- For line 7, report the sum of line 1 and any outstanding rollovers. This provides a conservative estimate of your IRA funds.

- Next, fill out line 8 with the total IRA distributions received in 1991, excluding specific types of distributions as described in the instructions.

- Calculate the decimal as indicated on line 9 by dividing line 6 by line 8. Ensure it is not more than 1.00.

- Multiply the value from line 8 by the decimal result from line 10 to find your nontaxable distributions, which will be entered on line 11.

- Fill out line 12 by subtracting line 11 from line 6 to find your basis in the IRA(s) as of 12/31/91.

- Complete line 14 by adding the amounts from lines 12 and 13 for your total IRA basis for 1991 and previous years.

- Finally, review the form for accuracy, sign the section as required, and submit the completed form according to IRS guidelines.

Get started with filling out your Ira Contributions 1991 Form online today to ensure accurate reporting and compliance.

Typically, you as the account holder report your IRA contributions to the IRS using the IRA Contributions 1991 Form. If you have an employer-sponsored IRA, your employer may also report contributions on your behalf. Make sure to provide accurate information to avoid any discrepancies. Consistently documenting your contributions helps maintain clear records for future reference.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.