Loading

Get Instructions For Filing Estimated Tax Vouchers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

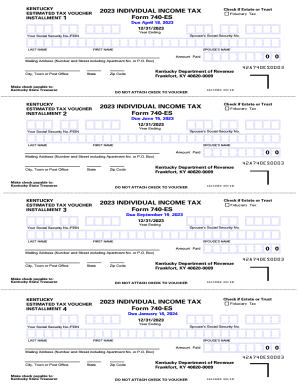

How to fill out the INSTRUCTIONS FOR FILING ESTIMATED TAX VOUCHERS online

Filing your estimated tax vouchers online is a straightforward process that can help ensure you meet your tax obligations efficiently. This guide provides clear, step-by-step instructions on how to complete the INSTRUCTIONS FOR FILING ESTIMATED TAX VOUCHERS, making the task manageable for everyone, regardless of prior experience.

Follow the steps to successfully complete your estimated tax vouchers form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred document viewer.

- Begin by entering the tax year for which you are filing in the designated field. Ensure this reflects the correct year ending.

- Provide your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the appropriate field. This information is crucial for identification.

- Fill in your last name, followed by your first name. If you are filing jointly with a partner, include their name in the spouse's name field.

- If applicable, input your spouse's Social Security Number in the designated area.

- Enter your mailing address, including the street number, street name, apartment number (if any), and P.O. Box if you use one.

- Complete your city, town, or post office information, followed by your state and zip code.

- Indicate the amount being paid in the 'Amount Paid' section. Ensure this amount is correct and reflects the estimated taxes owed.

- Review all filled sections for accuracy. Make any necessary corrections before finalizing the document.

- Once complete, you can save your changes, download, print, or share the form as needed. Make sure not to attach any checks to the voucher.

Start completing your estimated tax vouchers online today!

You must make estimated tax payments and file Form 1040-ES if both of these apply: Your estimated tax due is $1,000 or more. The total amount of your tax withholding and refundable credits is less than the smaller of:

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.