Loading

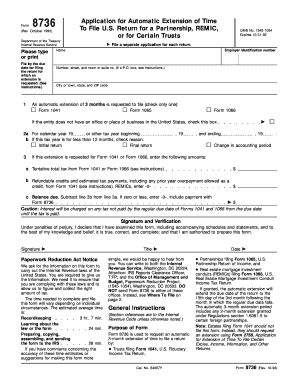

Get Form 8736. Application For Automatic Extension Of Time To File U.s. Return For A Partnership

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8736. Application For Automatic Extension Of Time To File U.S. Return For A Partnership online

Filling out Form 8736 is an essential step for partnerships, trusts, and real estate mortgage investment conduits seeking an automatic extension of time to file their U.S. tax returns. This guide offers clear instructions to help you complete the form accurately and ensure your extension request is processed smoothly.

Follow the steps to complete Form 8736 online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Provide the employer identification number in the designated field. Ensure this number is correct, as it is critical for identifying your entity.

- Enter the name of the partnership or trust in the appropriate section. This should match the legal name on record.

- In the address section, fill in the number, street, and room or suite number (if applicable). If you utilize a P.O. box, be sure to refer to the specific instructions.

- Complete the city or town, state, and ZIP code fields accurately to prevent processing delays.

- Indicate whether you are requesting an extension to file Form 1041, Form 1065, or Form 1066 by checking only one box.

- For the tax year section, fill in the calendar year or other tax year details, including the start and end dates.

- If applicable, check the reason box if the tax year is for less than 12 months. You can choose from initial return, final return, or change in accounting period.

- If you are requesting the extension for Form 1041 or Form 1066, input the tentative total tax, refundable credits, and estimated tax payments in the appropriate fields. Calculate the balance due and ensure any payment is included with the submitted form.

- Prepare for the review and verification section by confirming that the information entered is accurate and signed by an authorized individual. Be mindful of the penalties for incorrect submissions.

- Save your changes regularly to avoid losing any data as you fill out the form. Once completed, download a copy, print it, or share it as needed.

Complete your documents online today to ensure timely filing and compliance.

To extend your trust return, simply file Form 8736 with the IRS before the usual tax deadline. This form allows you to gain an automatic extension, ensuring you have ample time to prepare your trust tax return accurately. Utilizing this option helps you stay compliant and reduces the potential for stress during tax season.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.