Loading

Get Kentucky Personal Property Tax Form - Fill Out And Sign ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kentucky Personal Property Tax Form - Fill Out And Sign online

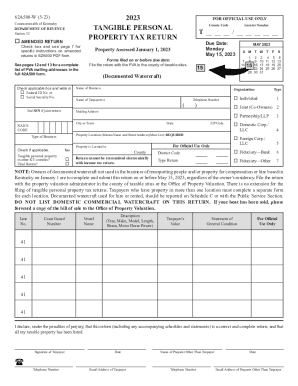

Filling out the Kentucky Personal Property Tax Form can seem daunting, but this guide will walk you through the process step-by-step. By completing this form accurately and timely, you can ensure compliance with state tax regulations while minimizing stress.

Follow the steps to correctly fill out your tax form.

- Click ‘Get Form’ button to obtain the Kentucky Personal Property Tax Form and open it in the editor.

- Indicate whether this is an amended return by checking the appropriate box. Refer to page 7 for detailed instructions related to amended returns.

- Complete the identification section by checking the applicable box for your Federal ID Number or Social Security Number, and provide the required details.

- Enter the name of your business and the names of the taxpayers involved. Ensure this information is accurate.

- Provide your contact information, including telephone number, and complete the mailing address section, ensuring to list city, state, and ZIP code correctly.

- Identify the property location, including any specific marina name or street address as required. This section is mandatory.

- Indicate the type of business and whether you operate in other Kentucky counties. Include the applicable NAICS code, and list any documented watercraft if necessary.

- Provide a statement of general condition of the property, including the name, the Coast Guard number, and details of the vessel, including year, make, model, length, and motor horsepower.

- Affirm the accuracy of your return by signing and dating the bottom section. If applicable, provide the name and contact information of any preparer other than yourself.

- After ensuring all sections are completed and accurate, save your changes, and decide to download, print, or share the completed form.

Complete and submit your Kentucky Personal Property Tax Form online today to stay compliant and avoid penalties.

Motor Vehicle Taxes in Kentucky Payment shall be made to the motor vehicle owner's County Clerk. Motor Vehicle Usage TaxMotor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. It is levied at six percent and shall be paid on every motor vehicle used in Kentucky.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.