Get 90 2247 Fdic Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 90 2247 FDIC Form online

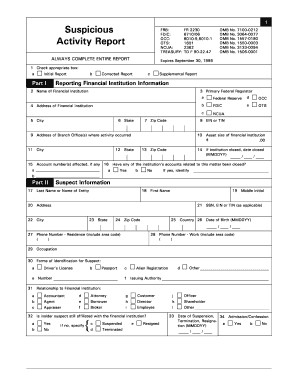

The 90 2247 FDIC Form is a crucial document used by financial institutions to report suspicious activities to the appropriate authorities. This guide provides a detailed, step-by-step approach to help you complete the form online effectively and accurately.

Follow the steps to complete the 90 2247 FDIC Form online

- Press the ‘Get Form’ button to access the 90 2247 FDIC Form and open it in your preferred editor.

- Begin by checking the appropriate box to identify if this is an initial report, a corrected report, or a supplemental report.

- In Part I, provide the name and address of the financial institution, along with its primary federal regulator.

- Fill in the institution's EIN or TIN, asset size, and indicate if the institution has closed, along with the closure date if applicable.

- Provide details regarding the affected account numbers, including whether any accounts have been closed.

- In Part II, enter the suspect information including their last name, first name, address, and other relevant personal details.

- Indicate the suspect's relationship to the financial institution and whether they are still affiliated.

- In Part III, describe the suspicious activity including the date, dollar amount involved, and a summary characterizing the nature of the activity.

- Provide additional details on the impact of the suspicious activity on the institution and whether law enforcement has been notified.

- In Part IV and V, complete witness and preparer information, ensuring all relevant details are accurately recorded.

- Finally, in Part VII, offer a comprehensive explanation and description of the suspicious activity, retaining evidence and documentation as necessary.

- Once you have filled out all the required sections, save your changes, and choose to download, print, or share the completed form accordingly.

Begin completing the 90 2247 FDIC Form online now to ensure timely and accurate reporting.

Adding beneficiaries can enhance your FDIC coverage by designating payable-on-death (POD) accounts. To do this, speak with your bank about the process, and provide their information along with your request. Each beneficiary typically increases coverage up to $250,000, so including several can significantly extend your protection. For an effective plan, consider also completing the 90 2247 FDIC Form for structured guidance on maximizing your insurance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.