Loading

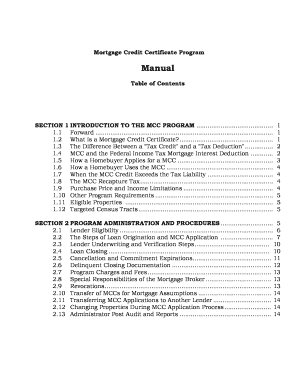

Get Section 1 Introduction To The Mcc Program

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SECTION 1 INTRODUCTION TO THE MCC PROGRAM online

This guide provides a clear and supportive overview of how to effectively complete Section 1 of the Mortgage Credit Certificate (MCC) Program. It carefully breaks down each component to assist users in navigating the online form with ease.

Follow the steps to accurately fill out the form.

- Click ‘Get Form’ button to access the necessary document and open it for editing.

- Review the introduction provided in the form. Familiarize yourself with the purpose of the MCC Program as outlined in Section 1.1, which offers context and background on the program's establishment.

- In Section 1.2, understand what a Mortgage Credit Certificate is. This section specifies the tax benefits and eligibility criteria related to the MCC.

- Proceed to Section 1.3 to comprehend the difference between a 'tax credit' and a 'tax deduction'. It's important to discern how these terms impact your finances and qualify for the program.

- In Section 1.4, learn how the MCC interacts with the Federal Income Tax Mortgage Interest Deduction. This section elucidates how utilizing the MCC affects other tax benefits.

- Section 1.5 explains how a homebuyer applies for the MCC. Make sure to note the steps required to submit your MCC application through a Participating Lender.

- Read Section 1.6 on how a homebuyer uses the MCC benefits. Understanding the operational aspect of the certificate will help in optimizing its usage.

- In Section 1.7, discover the implications when the MCC credit exceeds tax liability. It is essential to know how to carry forward any unused credits.

- Refer to Section 1.8, where the MCC Recapture Tax is discussed. Familiarize yourself with the conditions that might invoke this tax if affected.

- Section 1.9 and later sections detail the purchase price and income limitations, and other program requirements. Ensure you qualify under the stated criteria.

- Once all sections are reviewed and completed, finalize the form by saving your progress. You can download, print, or share the completed document as needed.

Start completing your MONITOR 1 INTRODUCTION TO THE MCC PROGRAM online today!

MCC's mandate is to assist the world's poorest countries in reducing poverty through economic growth while strengthening good governance, economic freedom, and investments in people in those countries selected to receive its assistance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.